Across demand channels, 2025 shows a clear change in how value and volume are distributed compared to 2024. While CPMs eased across most channels, the revenue share mix also shifted, reflecting where demand is concentrating and how different buying paths are contributing to overall monetization. Some channels leaned more on scale, while others continued to deliver a higher share of revenue through stronger pricing.

- Ad Exchange: Continues to lead on scale, with noticeable changes in how value is coming through.

- EBDA: Shows a clear step up in 2025, pointing to a growing role in the mix.

- Prebid: Holds its premium position, with signs of shifting competition.

- TAM: Remains steady, providing balance as other channels adjust.

Report Overview:

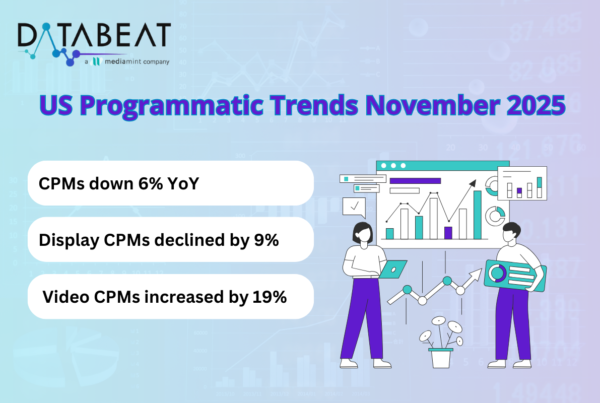

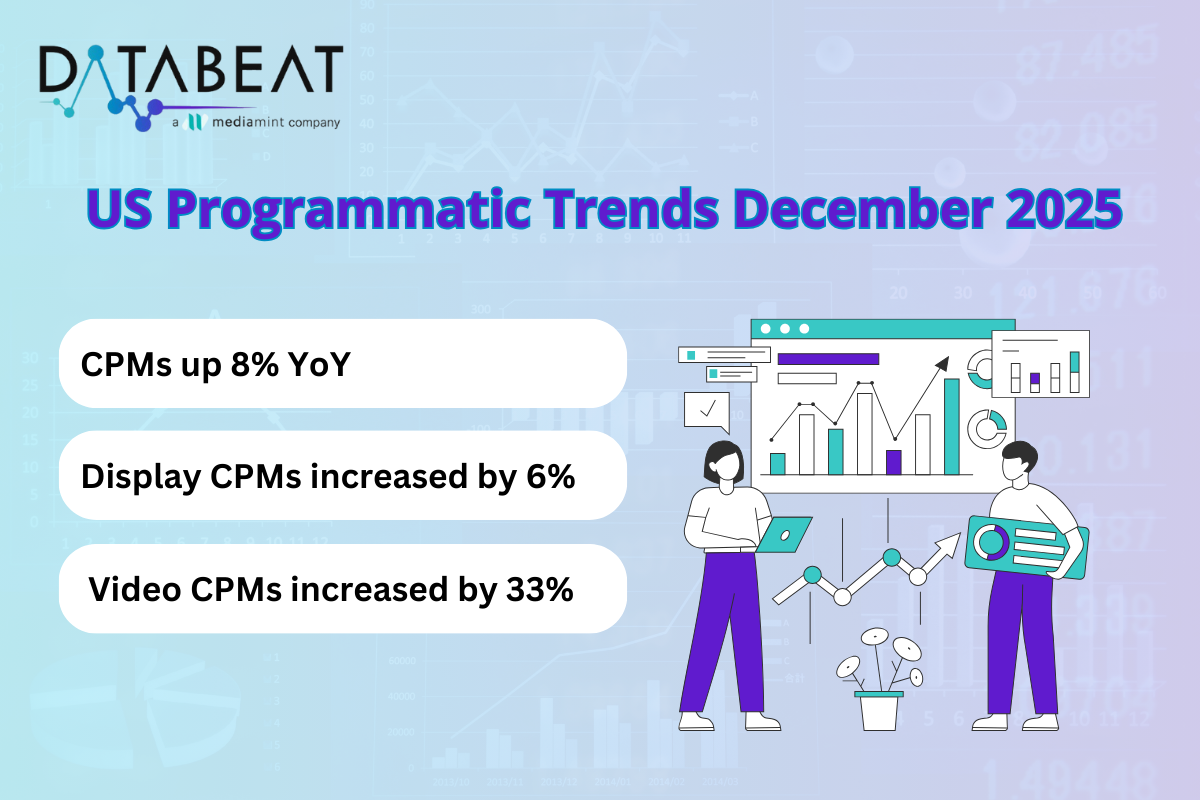

The DataBeat Programmatic Trends Report for December 2025 analyzes anonymized data from industry partners within the DataBeat network, focusing on programmatic advertising trends in the U.S. This report provides a detailed comparison of December 2025’s performance against both November 2025 and December 2024, offering insights into month-over-month and year-over-year changes.

Key Highlights:

- MoM, Display CPMs increased by 6.8%, Video CPMs increased by 1.9%, resulting in 6.5% increase in overall CPM.

- YoY, Display CPMs increased by 6.3% and Video CPMs increased by 33.2%, leading to an overall CPM increase of 7.9%.

- To mitigate the impact and drive recovery, publishers should focus on diversifying demand sources, optimizing floor prices, and leveraging header bidding to increase competition. Additionally, exploring high-performing ad formats and strengthening direct deals can help stabilize revenue in the coming months.