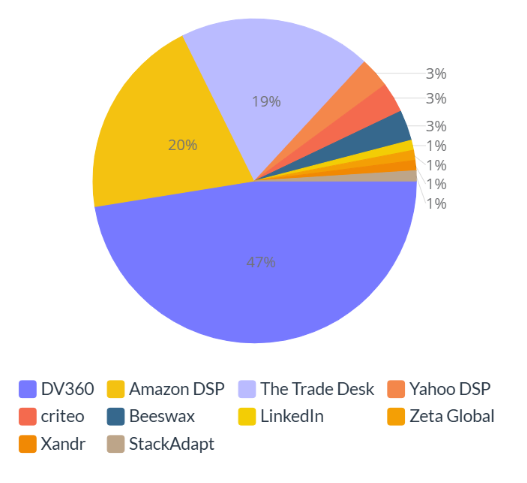

This month’s theme focuses on analyzing the top DSPs. DV360 leads the market with a 47% share, followed by Amazon DSP (20%) and The Trade Desk (19%), while other DSPs like Xandr, Yahoo DSP, LinkedIn, and StackAdapt each hold just 1%. The dominance of larger DSPs is driven by their scale, reach, and premium integrations, attracting more advertisers. Smaller DSPs focus on niche markets and specialized formats, limiting their share.

In terms of cost, DV360 has the lowest CPM at $0.89, followed by The Trade Desk ($1.07) and Amazon DSP ($1.17). Other DSPs like LinkedIn ($2.47), Yahoo DSP ($1.78), and Beeswax ($1.63) have higher CPMs due to targeted audiences, premium inventory, and limited supply, which increases competition and ad costs.

DSP Spending Trends: Market Share, CPM Variations & SSP Preferences :

DSPs like DV360, Amazon DSP, and Xandr allocate the majority of their spend to their company-owned SSPs/Exchanges—DV360 to AdX, Amazon DSP to Amazon SSP, and Xandr to Xandr SSP. This preference ensures better efficiency, data control, and access to premium inventory, aligning with each platform’s ecosystem.

High-market-share DSPs like The Trade Desk (TTD) and DV360 allocate around 50% of their spend through AdX, indicating a strong alignment between buyer demand and AdX’s publisher inventory. Their low CPMs ($1) suggest that AdX primarily serves high-volume, low-cost inventory, commonly found in news category publishers, which generally have lower CPMs compared to verticals like arts, culture, and gaming.

This trend could also be attributed to AdX’s extensive global market coverage, giving advertisers access to a broader range of publishers. In contrast, other SSPs or Exchanges may have more limited reach, focusing on specific markets or premium inventory, resulting in higher CPMs.

In contrast, other DSPs like LinkedIn, Beeswax, and StackAdapt heavily rely on Magnite due to better alignment with their advertiser base. LinkedIn’s DSP share is smaller but has high CPMs, indicating that its traffic comes from premium, high-CPM publishers in categories like arts, culture, and business studies, which demand higher ad rates.If you’re an advertiser seeking strong performance at a lower cost, consider shifting your budget to AdX for more efficient CPMs. However, if your focus is on specific targeting parameters and premium inventory, Magnite would be the better choice.

Report Overview:

The DataBeat Programmatic Trends Report for February 2025 analyzes anonymized data from industry partners within the DataBeat network, focusing on programmatic advertising trends in the U.S. This report provides a detailed comparison of February 2025’s performance against both January 2025 and February 2024, offering insights into month-over-month and year-over-year changes.

Key Highlights:

MoM, Display CPMs increased by 6.3%, Video CPMs increased by 25.9%, resulting in an overall CPM increase of 10%.

YoY, Display CPMs declined by 35.8% and Video CPMs dropped by 26.4%, leading to an overall CPM decrease of 39.3%.

The YoY decline in CPM from Q1 2024 (Jan-Feb) to Q1 2025 (Jan-Feb) may be influenced by the US political cycle. While Q1 2024 CPMs were significantly higher than in previous years. This increase was likely driven by early PMP campaign activations as nominee selections began. However, in Q1 2025, CPMs have declined, potentially due to reduced political ad spend post-election. Additionally, economic factors tied to Trump’s political activity may be impacting consumer spending and ad budgets, particularly for Chinese companies and marketplace sellers, which have been key contributors to ad sales growth in social and retail media. Their financial strain could be further accelerating the observed CPM decline.

To mitigate the impact and drive recovery, publishers should focus on diversifying demand sources, optimizing floor prices, and leveraging header bidding to increase competition. Additionally, exploring high-performing ad formats and strengthening direct deals can help stabilize revenue in the coming months.

Here’s a look at industry trends, broken down by inventory and demand.

1. Display Trend

- Display CPMs increased by 6.3% month-over-month and experienced a 38.2% decline year-over-year.

- Almost all SSPs saw a month-over-month CPM increase, indicating that this trend is consistent across most SSPs. When looking at year-over-year performance, all SSPs demonstrated a decrease in CPMs.

2. Video Trend

- Video CPMs went up by 24% month-over-month and experienced a 35% decline year-over-year.

- Almost all SSPs saw a month-over-month CPM increase, with the exception of IndexExchange , indicating that this trend is consistent across most SSPs. However, when looking at year-over-year performance, SSPs like Telaria demonstrated a significant increase in CPMs.

3. Device Trends

- Both Mobile and Desktop CPMs saw a month-over-month uplift, with Mobile increasing by 9% and Desktop by 8%. Year-over-year declines were also observed, with Mobile falling by 35% and Desktop by 32%.

- CTV CPMs increased month-over-month by 43%, and year-over-year saw a decrease by 13%. Ad Exchange claimed the top rank in terms of volume.

4. Programmatic Integrations

- Prebid leads the market with a 39% share, closely followed by AdX at 34%, TAM at 26%, and EBDA at 2%. While CPMs for integration such as Prebid increased month-over-month while other integrations have mostly declined. Whereas year-over-year, all integrations have mostly seen a decline.

5. AdX Advertisers

- Among advertisers, TEMU claims the top position, with a CPM of $1.87, with a 64% MoM increase.

- Amazon and Adobe also saw notable rank increases, both maintaining CPMs above $1.00, with Amazon experiencing a 105% CPM uplift and Adobe seeing a 74% incline.

6. AdX Bidders

- Google Ads and DV360 showed an increase in ranking among bidders, while other bidder rankings remained relatively stable.

- Most AdX bidders experienced an increase in CPMs month-over-month, with the exception of Beeswax and Yahoo which showed decrease in their CPMs.

For a detailed overview, please download the full report.