Browser Level Insights:

In the competitive landscape of digital advertising, understanding browser-level CPMs is crucial for publishers aiming to optimize programmatic revenue. Google Chrome and Safari are two dominant players, each presenting unique dynamics in CPM rates. Chrome, with its robust cookie support, typically commands higher CPMs due to better ad targeting capabilities. In contrast, Safari’s privacy-focused approach, which limits third-party cookies, often results in lower CPMs. For publishers, grasping these differences can help in strategizing ad placements and maximizing revenue across different browsers.

- Our analysis of browser-level data shows Google Chrome leading on mobile with a 53% share, while Safari has 47%. Safari’s CPMs are 47% lower than Chrome’s, and ad request CPMs are 55% lower, due to Safari’s lack of third-party cookie support which limits ad targeting. This highlights a current preference for better-targeted environments, though this may shift with evolving privacy standards.

- On desktop, Chrome also leads with a 61% share, while Safari and Microsoft Edge each hold 17%, and Firefox captures 5%. The CPM gap on desktop is smaller, with Safari and Microsoft Edge showing only an 11% lower CPM compared to Chrome. This suggests more consistent ad performance across desktop browsers due to fewer privacy restrictions compared to mobile.

For more insights on browser-level CPM dynamics and optimizing ad strategies in a cookie-free environment, check out our article “Cookie Apocalypse: A Guide to Privacy-Compliant Targeting.“

Report Overview:

The DataBeat’s Programmatic Trends Report for August 2024 is based on an analysis of anonymized data gathered from various industry partners within the DataBeat network. In this report, we examined the performance of programmatic advertising demand in the United States for August 2024, comparing it to both July 2024 and August 2023 performances.

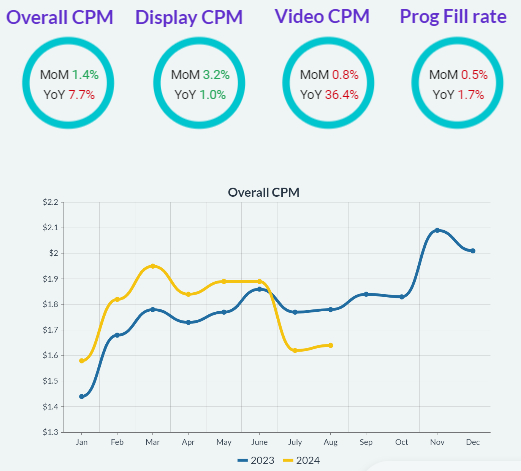

Key Highlights:

CPMs have started to stabilize with a modest 1.4% increase after a steep decline in July, although they are still down 7.7% year-over-year. Display CPMs are showing slight improvement, while Video CPMs remain consistent month-over-month but are down by 36% compared to last year. This suggests a gradual market recovery, yet the video sector continues to face challenges as it adjusts to ongoing industry changes.

As the U.S. Presidential elections approach, CPMs are expected to rise more quickly due to heightened demand from political advertisers. Now is the time for advertisers to strategically allocate their budgets to secure prime ad placements, while publishers should review and optimize their political ad blocks and UPR flooring strategy. Taking these steps early will allow both advertisers and publishers to capitalize on the increased ad spend expected during this period.

Media Trends:

The 2024 display CPM trend largely follows that of 2023, with a notable rebound in August showing a 3% month-over-month increase despite lower CPMs in June and July. AdX, holding a 39% volume share, has the lowest CPMs among SSPs, indicating that publishers should consider integrating Prebid and TAM partners to boost CPMs and enhance competition against AdX.

In the video SSP landscape, most partners saw month-over-month growth, except Connatix and Media.net. OpenX distinguished itself with strong video CPM performance, experiencing only a 4% year-over-year decline compared to the broader 36% industry drop, demonstrating its strong market position.

Device Trends:

Mobile CPMs dropped by 14% year-over-year, whereas Desktop CPMs only fell by 4% and saw a 4% month-over-month increase, outperforming Mobile. Meanwhile, CTV experienced a positive trend, with CPMs increasing by 11.7% month-over-month and 10% year-over-year, fueled by growth from SSPs like Telaria, Connatix, and Qortex.

Programmatic Integrations:

AdX maintains a leading 41% share in the programmatic space, but its CPMs have fallen by over 27% year-over-year, primarily due to its substantial video inventory. In contrast, Prebid is seeing robust performance, with CPMs rising nearly 5% month-over-month and year-over-year, driven by significant CPM increases from SSPs like Teads and Criteo.

AdX Advertiser’s:

In August, Schottenstein Stores climbed 224 ranks to the 3rd position with a remarkable CPM of $11.23, up 1204% month-over-month. Louis Vuitton rose 50 ranks to 4th place, achieving a CPM of $4.11, marking an 87% increase. Retail brands, including Schottenstein Stores, Louis Vuitton, and Walmart, showed strong performance with notable rank improvements, highlighting a positive trend in the sector.

For a detailed overview, please download the full report.