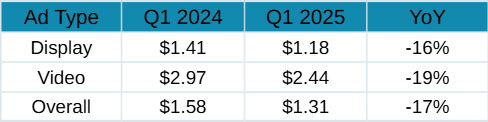

This month, we spotlight the evolving quarterly CPM performance, with a focus on the year-over-year comparison between Q1 2024 vs Q1 2025 and Q4 2024 vs Q1 2025. The data reveals an approximate 17% decline in CPMs YoY 2024 Q1 vs 2025 Q1, highlighting a noticeable softening in monetization on a quarter-over-quarter basis.

- This downward trend is primarily attributed to a reduction in advertiser budgets in early 2025. In contrast, Q1 2024 experienced heightened demand, driven in part by increased political advertising and stronger campaign spending. With political campaigns behind and a more conservative fiscal approach from advertisers in 2025, CPMs have dipped in response to lower auction pressure and cautious investment behavior.

- Comparing Q4 2024 to Q1 2025, there’s a notable 23% decline—likely influenced by seasonal trends following the high holiday spend in Q4. While a Q1 dip is expected, the magnitude of this drop could point to wider monetization challenges. Contributing factors may include recession concerns and rising U.S. tariffs, which could dampen consumer spending and, in turn, impact campaign performance on the DSP side.

Quarterly Performance Overview: Q1 2024 vs Q1 2025 || Q4 2024 vs Q1 2025:

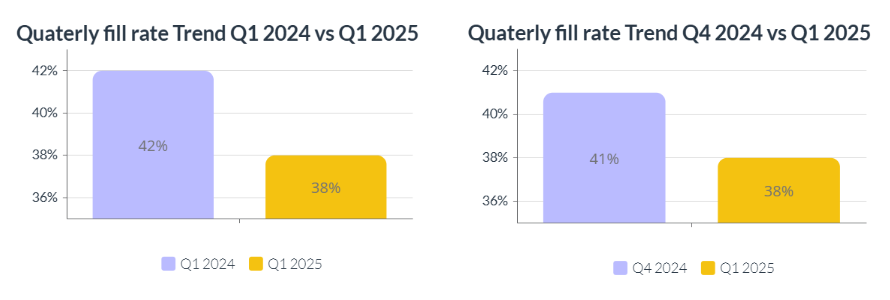

Ad ExchangeCPM: $0.97 → $0.99 (+2% QoQ)

- Despite an overall downward trend in the market, Ad Exchange saw a slight CPM lift. This could indicate better optimization, improved demand density, or increased bid competition in open auction.

- Amazon (-29%) and Index Exchange (-18%) experienced significant CPM drops in Q1 2025, largely driven by reduced brand spend and tighter competition in programmatic auctions, with Amazon impacted more due to retail demand slowdown and IX reflecting broader SSP market softness.

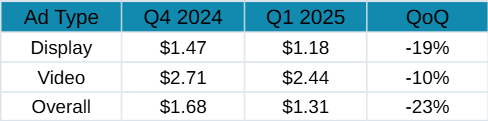

Fill rate dropped from 42% in Q1 2024 to 38% in Q1 2025, reflecting softer demand and more selective buying, possibly influenced by stricter ad quality standards and reduced campaign volumes.

- Stricter IAB Regulations: Particularly impacting instream and outstream video.

- Reduced Budgets: Lower spend in Q1 2025 vs Q1 2024, especially outside of political cycles.

- Shift in Buyer Behavior: More focus on performance and ROI, leading to selective bidding.

- Ad Tech Adjustments: Increased focus on viewability, brand safety, and privacy compliance has led to filtered impressions and reduced bid density.

Publisher Optimization Strategies :

- Test High-Value Ad Formats – (Instream video,Native format)

- Leverage First-Party Data & Contextual Targeting

- Align Content With High RPM Categories

- Secure Direct Deals & Programmatic Guaranteed

- Continuous Monitoring & Testing

Report Overview:

The DataBeat Programmatic Trends Report for March 2025 analyzes anonymized data from industry partners within the DataBeat network, focusing on programmatic advertising trends in the U.S. This report provides a detailed comparison of March 2025’s performance against both February 2025 and March 2024, offering insights into month-over-month and year-over-year changes.

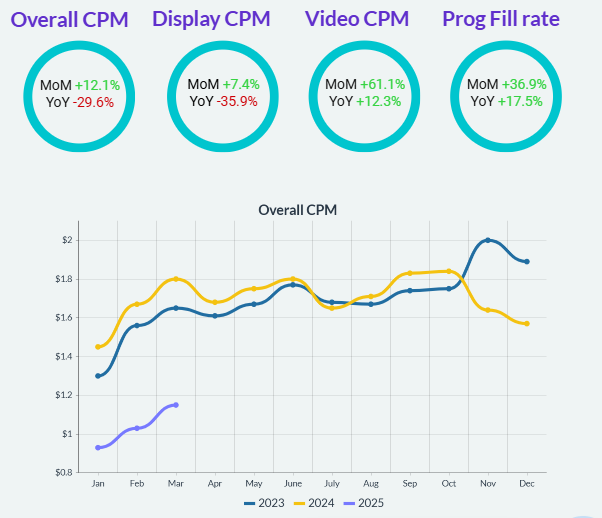

Key Highlights:

- MoM, Display CPMs increased by 7.4%, Video CPMs increased by 61.1%, resulting in an overall CPM increase of 12.1%.

- YoY, Display CPMs declined by 35.9% and Video CPMs increased by 12.3%, leading to an overall CPM decrease of 29.6%.

The YoY decline in CPM from Q1 2024 (Jan-Mar) to Q1 2025 (Jan-Mar) may be influenced by the US political cycle. While Q1 2024 CPMs were significantly higher than in previous years. This increase was likely driven by early PMP campaign activations as nominee selections began. However, in Q1 2025, CPMs have declined, potentially due to reduced political ad spend post-election. Additionally, economic factors tied to Trump’s political activity may be impacting consumer spending and ad budgets, particularly for Chinese companies and marketplace sellers, which have been key contributors to ad sales growth in social and retail media. Their financial strain could be further accelerating the observed CPM decline.

To mitigate the impact and drive recovery, publishers should focus on diversifying demand sources, optimizing floor prices, and leveraging header bidding to increase competition. Additionally, exploring high-performing ad formats and strengthening direct deals can help stabilize revenue in the coming months.

Here’s a look at industry trends, broken down by inventory and demand.

1. Display Trend

- Display CPMs increased by 7.4% month-over-month and experienced a 35.9% decline year-over-year.

- All SSPs saw a month-over-month CPM increase, indicating that this trend is consistent across most SSPs. When looking at year-over-year performance, all SSPs demonstrated an increase in CPMs with an exception to Rubicon and Appnexus.

2. Video Trend

- Video CPMs increased by 61% month-over-month and experienced a 12% increase year-over-year.

- Almost all SSPs saw a month-over-month CPM increase, with the exception ofTelaria, indicating that this trend is consistent across most SSPs. When looking at year-over-year performance, SSPs like Telaria, OpenX and Rubicon demonstrated a significant increase in CPMs.

3. Device Trends

- Both Mobile and Desktop CPMs saw a month-over-month increase, with Mobile increasing by 0.4% and Desktop by 13.7%. Year-over-year declines were also observed, with Mobile falling by 38% and Desktop by 30%.

- CTV CPMs increased month-over-month by 18%, and year-over-year saw a slight increase. Prebid claimed the top rank in terms of volume.

4. Programmatic Integrations

- Prebid leads the market with a 39% share, closely followed by AdX at 38%, TAM at 17%, and EBDA at 6%. While CPMs for integrations increased month-over-month with an exception to EBDA which dropped by 10% . Whereas year-over-year, all integrations have seen a decline.

5. AdX Advertisers

- Among advertisers, TEMU claims the top position, with a CPM of $1.96, with a 4.7% MoM increase.

- Amazon and Adobe also saw notable rank increases, both maintaining CPMs above $1, with Amazon experiencing a 31% CPM increase and Adobe seeing a 32% incline.

6. AdX Bidders

- Google Ads and DV360 showed an increase in ranking among bidders, while other bidder rankings remained relatively stable.

- Most AdX bidders experienced an increase in CPMs month-over-month, with the exception of TemuDSPand travel audience GmbH which showed an decrease in their CPMs.

For a detailed overview, please download the full report.