This month’s spotlight highlights the shifting CPM trends, comparing Q3 2025 with both Q3 2024 and Q2 2025. Our analysis shows a significant 35% year-over-year decline in CPMs, signaling a clear slowdown in monetization momentum. This drop reflects tighter advertising budgets and a broader market correction continuing through 2025.

- It’s evident that CPMs in 2025 are under strong downward pressure compared with last year. This trend is not new but a continuation of the softening seen in previous quarters. Moreover, the elevated ad spend during the 2024 U.S. presidential elections amplified CPMs last year, further widening the performance gap when compared to 2025.

- In Q3 2025, CPMs rose by 6% for display and 5% overall compared to the previous quarter. This steady upward trend shows normal market behavior as brands start increasing their spending ahead of the year-end period. Video CPMs stayed mostly the same, with only a small 2% drop, showing signs of stability across formats. While this quarterly growth is encouraging, year-over-year CPMs are still much lower, reflecting ongoing caution and tighter advertiser budgets.

Report Overview:

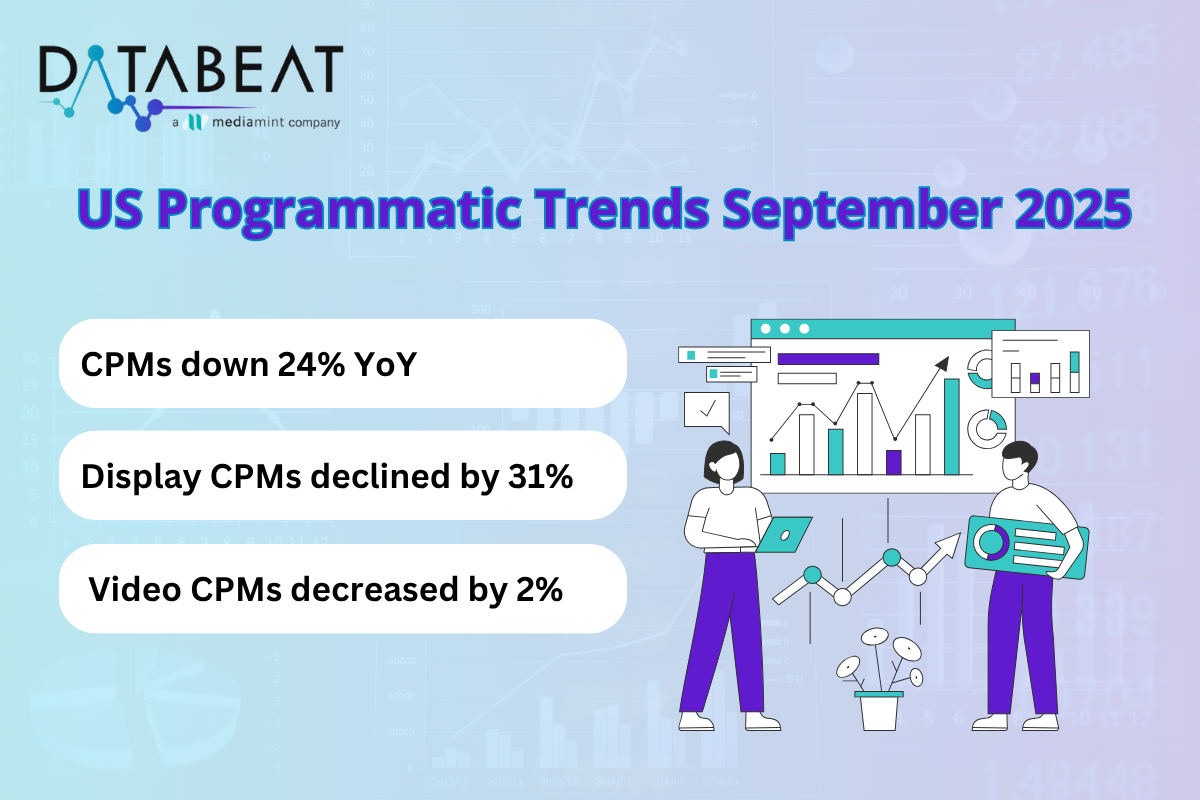

The DataBeat Programmatic Trends Report for September 2025 analyzes anonymized data from industry partners within the DataBeat network, focusing on programmatic advertising trends in the U.S. This report provides a detailed comparison of September 2025’s performance against both August 2025 and September 2024, offering insights into month-over-month and year-over-year changes.

Key Highlights:

- MoM, Display CPMs increased by 14%, Video CPMs increased by 37%, resulting in a 15% increase in overall CPM.

- YoY, Display CPMs declined by 31% and Video CPMs decreased by 2%, leading to an overall CPM decrease of 24%.