Change in CPMs with Viewability Buckets:

For September’s theme, we examined how CPMs fluctuate based on different viewability ranges. We divided viewability into 10 buckets, each representing a 10% range from 0% to 100%. Using a base CPM of $1 for the 0-10% bucket, we tracked changes in CPMs as viewability increased while progressing through the buckets.

Our research uncovered some intriguing insights:

- Limited Growth in CPMs has been observed in the initial 5 Buckets, except for the 11-20% range, where CPMs are 19% higher compared to the lowest bucket.

- CPMs are nearly 30% higher in the 51-60% bucket compared to the previous bucket, indicating that advertisers typically need at least 50% viewability to bid more competitively.

- Slight change has been observed when moving to the 61-70% bucket, which implies that strategies to increase viewability from 51-60% to 61-70% through lazy loading or adjusting ad positions might not yield substantial revenue uptick.

- CPMs rise once again viewability exceeds 70%, as most advertiser deals typically target for 70-80% viewability. However, CPMs drop by 10% in the >90% bucket, as lower-CPM ad units (such as adhesion units) tend to dominate this range.

Report Overview:

The DataBeat’s Programmatic Trends Report for September 2024 is based on an analysis of anonymized data gathered from various industry partners within the DataBeat network. In this report, we examined the performance of programmatic advertising demand in the United States for September 2024, comparing it to both August 2024 and 2023 performances.

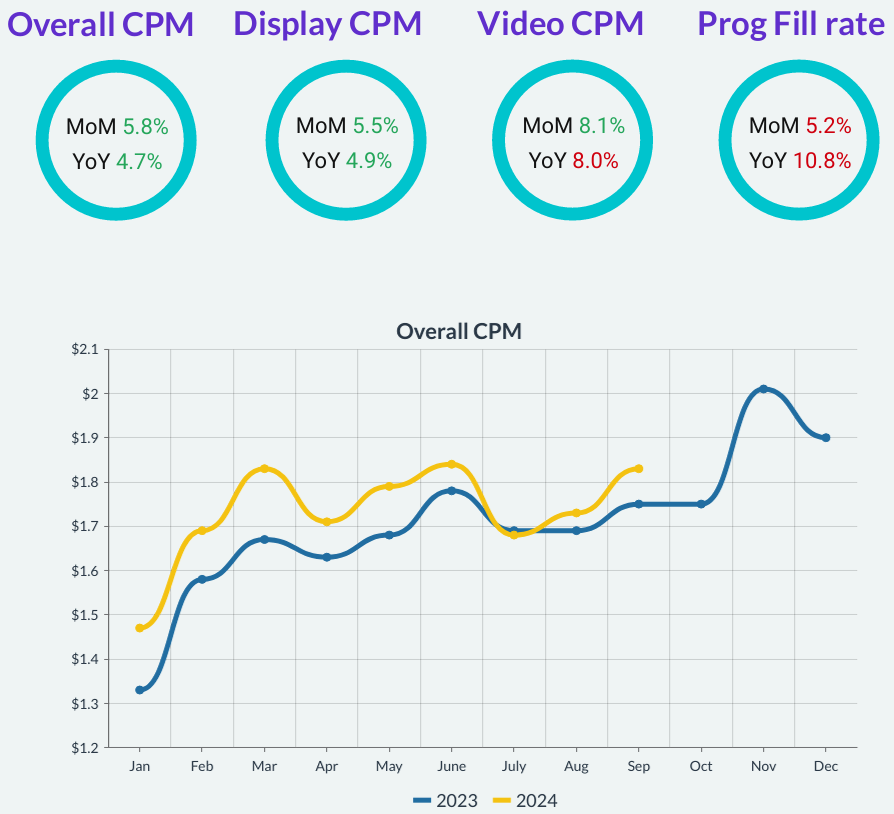

Key Highlights:

CPMs experienced a solid growth of 5.8% MoM and 4.7% YoY. Display CPMs followed a similar upward trend, while Video CPMs saw a notable 8% MoM increase, though they remain down by 8% YoY. Are you seeing similar trends in your data?

With less than a month to go before the U.S. presidential elections, CPMs are expected to surge, aligning with the typical Q4 upward trend. This is also an ideal time for publishers to review their political ad blocks and update their UPR flooring strategy, testing adjustments to capitalize on the increased demand during this period.

Media Trends:

In September, Display CPMs demonstrated a positive trend, with a 5.5% month-over-month increase and 5% year-over-year growth. Among SSPs, AdX holds the largest volume share at 39%, but its CPMs remain lower compared to other partners. This indicates that publishers could benefit from integrating Prebid and TAM, which could help drive higher CPMs and increase competition with AdX for better monetization.

Video CPMs have begun to recover from their July lows, following a trend similar to last year’s, though they remain 8% lower year-over-year. Most SSPs showed positive month-over-month growth, except for Rubicon, Rise, and Telaria. Despite their slower growth, both Rise and Telaria saw significant improvements in their rankings, indicating strong overall performance.

Device Trends:

Mobile CPMs saw a 4% year-over-year decline, while Desktop CPMs grew by 10%. Despite this, Mobile outperformed Desktop month-over-month, with a 7% increase compared to Desktop’s 3%. Meanwhile, CTV continues its steady growth, with a 6% rise both month-over-month and year-over-year.

To explore opportunities in the CTV space, don’t miss our exclusive CTV Advertising Webinar on October 25th at 1 PM EST Register here

Programmatic Integrations:

Prebid leads the market with a 43% share, followed by AdX at 35%, TAM at 14%, and EBDA at 8%. Although all integrations showed positive growth, TAM experienced a 5% year-over-year decline. AdX saw strong month-over-month growth with a 10% increase, while Prebid rose by 5%. Year-over-year, AdX CPMs increased by 3.5%, whereas Prebid showed a robust 9% surge.

AdX Advertiser’s:

General Motors surged 13 ranks to secure 3rd place with a high CPM of $3.34, reflecting a 50% month-over-month increase. AT&T and Walmart rose to the 6th and 7th positions, though their CPMs remain lower than other advertisers. Deutsche Telekom also saw significant growth, landing in 10th with a CPM of $3.29. Temu DSP climbed from 10th to 5th, supported by a strong CPM of $3.20 and 45% month-over-month growth. Except for Acuity Ads, all bidders saw increases, with Google Ads, Facebook, The Trade Desk, and Temu DSP showing strong performance.

For a detailed overview, please download the full report.