Curated vs Non-Curated CPM % diff by SSP:

For October’s theme, we delved into the CPM differences between curated and non-curated inventory across various SSPs that offer a curation feature. This analysis sheds light on how curated deals impact pricing dynamics in the programmatic ecosystem.

For those unfamiliar with curated deals or sell-side curation: Curated deals are premium programmatic packages assembled by SSPs or curation platforms, To know more – Refer to this article

Our research uncovered some intriguing insights:

- On average, SSPs provide 25% higher CPMs for curated inventory compared to non-curated inventory, highlighting the premium value of curated deals.

- Index Exchange, Pubmatic, and Rubicon lead with a 20% share of curated inventory within open auctions. These SSPs also offer a minimum of 25% higher CPMs for curated inventory, showcasing their dominance in both volume and pricing.

- Google AdX, while having a negligible curated inventory share of less than 2%, delivers an impressive 36% higher CPMs for curated deals. Similarly, OpenX, with just a 2.7% share, offers 33% higher CPMs compared to non-curated inventory.

- Appnexus and Sharethrough strike a balance, holding a decent share of curated inventory and providing around 15% higher CPMs, proving their ability to capture value in this segment.

Report Overview:

The DataBeat Programmatic Trends Report for October 2024 analyzes anonymized data from industry partners within the DataBeat network, focusing on programmatic advertising trends in the U.S. This report provides a detailed comparison of October 2024’s performance against both September 2024 and October 2023, offering insights into month-over-month and year-over-year changes.

Key Highlights:

MoM, while Display CPMs dropped by 1.4% and Video CPMs edged up by 0.4%, the overall CPM increased by 1%, thanks to video’s volume share growing from 13% to 15%

Similarly YoY, While Display CPMs increased by 3% and Video CPMs dropped by 7.7%, the overall CPM still rose by 5.3%, driven by video’s growing share of total volume, which climbed from 11% to 15%, showcasing the rising importance of video in programmatic advertising.

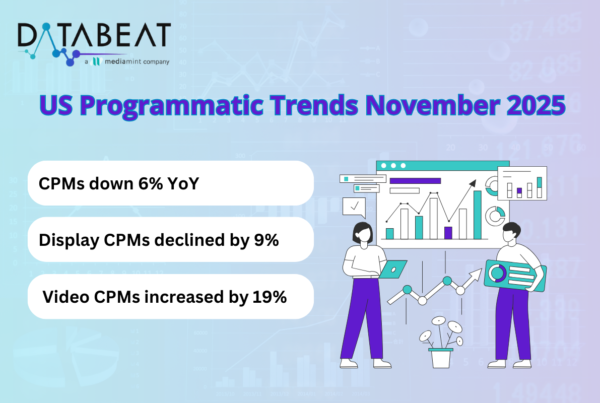

With November here and Q4 in full swing, CPMs are set to climb significantly if last year’s trend is any indication. Publishers, now’s the time to fine-tune those optimization strategies and maximize returns as advertiser demand hits peak levels!

Media Trends:

Display CPMs dropped 1% MoM but rose 3% YoY, with most SSPs showing declines except Rubicon. YoY, SSPs like Amazon, Kargo, and Media.net saw significant gains.

Video CPMs were stable MoM with a 0.4% rise but remain 7.7% lower YoY, continuing the year-long downward trend. Telaria stood out with a 94% YoY CPM increase, reaching an impressive $8.25 average.

Device Trends:

Mobile and Desktop CPMs remained steady MoM, but YoY trends diverged—Mobile CPMs declined by 3.5%, while Desktop CPMs rose by 9%. CTV CPMs saw growth both MoM and YoY, increasing by 3.5% and 2.2%, respectively. Telaria led the charge, ranking highest in volume and recording an impressive 47% YoY growth with a $6.18 CPM.

Programmatic Integrations:

Prebid dominates the market with a 38% share, followed closely by AdX at 37%, TAM at 16%, and EBDA at 9%. While most integration CPMs stayed flat or declined MoM, TAM stood out with a 3.6% increase. Year-over-year, Prebid CPMs surged by 10%, outperforming AdX and TAM. This impressive growth was driven by strong performances from Kargo, Criteo, Rise, and Teads, which significantly boosted CPMs.

AdX Advertiser’s:

Intercontinental Hotels surged 372 ranks to 2nd position with a $16.60 CPM, a 14X increase MoM. JP Morgan Chase and Hewlett Packard also saw significant rises with CPMs above $7, marking a 3X growth. Among bidders, RTB House and Centro saw slight rank increases, while most AdX bidders experienced a CPM drop, except for Facebook, Acuity Ads, and Centro, which saw gains.

For a detailed overview, please download the full report.