This analysis reviews year-over-year performance across 2025, examining key KPIs such as Impressions, Revenue and CPM to understand how shifts in supply, demand, and pricing shaped monetization across inventory types and devices. By tracking quarterly changes in impressions, revenue, and CPMs, it highlights where pricing gains supported performance and where declining volume constrained revenue. The analysis also considers buyer behavior and inventory mix to clarify the primary drivers behind 2025’s market outcomes and optimization signals for publishers.

- Advertiser caution shaped performance throughout 2025, with pricing showing signs of recovery but failing to fully counterbalance weakening volume. Even as demand stabilized mid-year, efficiency-driven buying limited revenue upside.

- Volume, rather than pricing, became the defining constraint, especially in the latter half of the year. Stable pricing alone was not enough to lift monetization, highlighting deeper structural pressures shaping the market.

Report Overview:

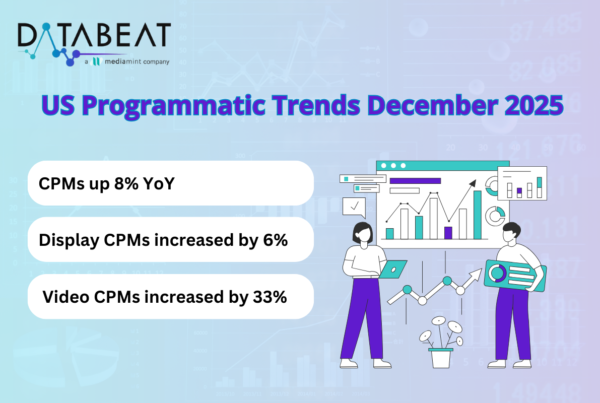

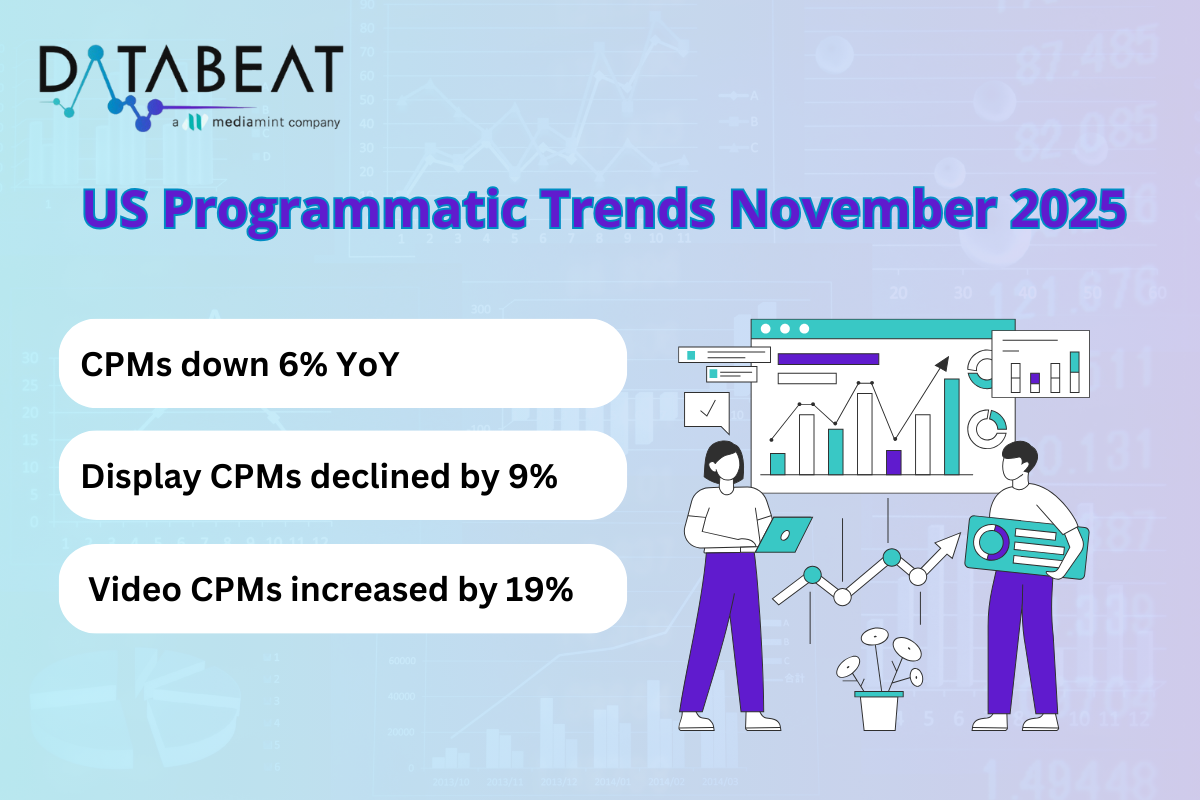

The DataBeat Programmatic Trends Report for November 2025 analyzes anonymized data from industry partners within the DataBeat network, focusing on programmatic advertising trends in the U.S. This report provides a detailed comparison of November 2025’s performance against both October 2025 and November 2024, offering insights into month-over-month and year-over-year changes.

Key Highlights:

- MoM, Display CPMs increased by 12.3%, Video CPMs decreased by 2.5%, resulting in 10.1% increase in overall CPM.

- YoY, Display CPMs declined by 8.8% and Video CPMs increased by 18.9%, leading to an overall CPM decrease of 5.6%.

- To mitigate the impact and drive recovery, publishers should focus on diversifying demand sources, optimizing floor prices, and leveraging header bidding to increase competition. Additionally, exploring high-performing ad formats and strengthening direct deals can help stabilize revenue in the coming months.