Comprehensive SSP Analysis: Performance, Market Share, and Strategic Insight:

- Rubicon, TripleLift, and PubMatic exhibit similar performances across TAM and Prebid due to platform-specific capabilities. these partners holds the highest SOV on Prebid, while TAM achieves higher CPMs for all three, driven by its larger video inventory and compatibility with players like Connatix with TAM integration

- TAM’s ability to connect with multiple audience segment ID solutions further enhances targeting, which may not be fully supported in Prebid configurations. To optimize, publishers can route video inventory through TAM and display inventory through Prebid. This approach is particularly effective for TTD, where duplicate requests are not allowed, ensuring efficient Supply Path Optimization.

- IndexExchange holds the highest SOV in EBDA integration at 41% and appears to be the only partner performing well in this setup, with CPM remaining consistent across integrations.

Report Overview:

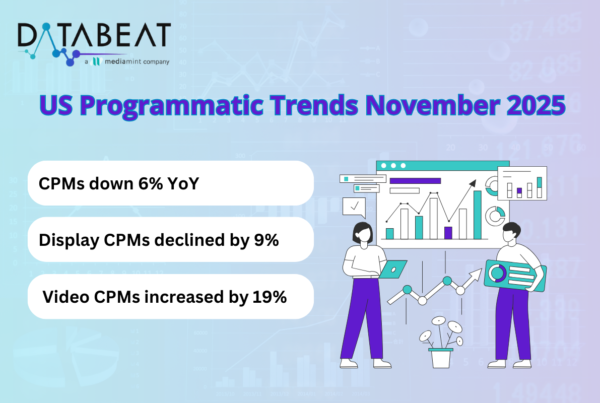

The DataBeat Programmatic Trends Report for November 2024 analyzes anonymized data from industry partners within the DataBeat network, focusing on programmatic advertising trends in the U.S. This report provides a detailed comparison of October 2024’s performance against both September 2024 and October 2023, offering insights into month-over-month and year-over-year changes.

Key Highlights:

MoM, while Display CPMs increased by 2% and Video CPMs dropped by 14.2%, the overall CPM decreased by 0.7%, thanks to video ’ s volume share growing from 13% to 15%. Similarly YoY, While Display CPMs decreased by 17.9% and Video CPMs dropped by 31.1%, the overall CPM dropped by 17.1%, driven by video ’ s growing share of total volume, which climbed from 11% to 15%, showcasing the rising importance of video in programmatic advertising.

With November here and Q4 in full swing, CPMs are set to climb significantly if last year ’ s trend is any indication. Publishers, now ’ s the time to -tune those optimization strategies and maximize returns as demand hits peak levels!

1. Display Trend

Display CPMs rose by 2% MoM but declined by 17.9% YoY. While most SSPs showed MoM improvements, Amazon, OpenX, and PubMatic were exceptions. On a YoY basis, all SSPs except GumGum reported decreases.

2. Video Trend

Video CPMs fell sharply, dropping 14.2% MoM and 31.1% YoY. OpenX, AdX, and Index Exchange performed positively MoM, but only Telaria and Index Exchange avoided YoY declines.

3. Device Trends

CPMs increased for Desktop and Tablet MoM but declined by 1.6% for Mobile. Across all device types, YoY CPMs fell. CTV CPMs dropped 4% MoM and 10.8% YoY, although Telaria stood out with 221.1% YoY growth and a CPM of $11.18.

4. Programmatic Integrations

Prebid led programmatic integrations with 43% market share, followed by AdX (26%), TAM (18%), and EBDA (13%). MoM CPMs grew for all except Prebid (-5.8%), and YoY CPMs declined across the board.

5. AdX Advertisers

TEMU secured the top position with a CPM of $1.4 (+9.9% MoM), while CoStar Group ($1.84) and Best Buy ($2.16) saw significant MoM growth of 63.1% and 12.3%, respectively.

6. AdX Bidders

Google Ads and DV360 showed slight ranking improvements, while most bidders saw MoM CPM growth. However, Facebook NB, Yahoo DSP, and Acuity Ads experienced declines.

For a detailed overview, please download the full report.