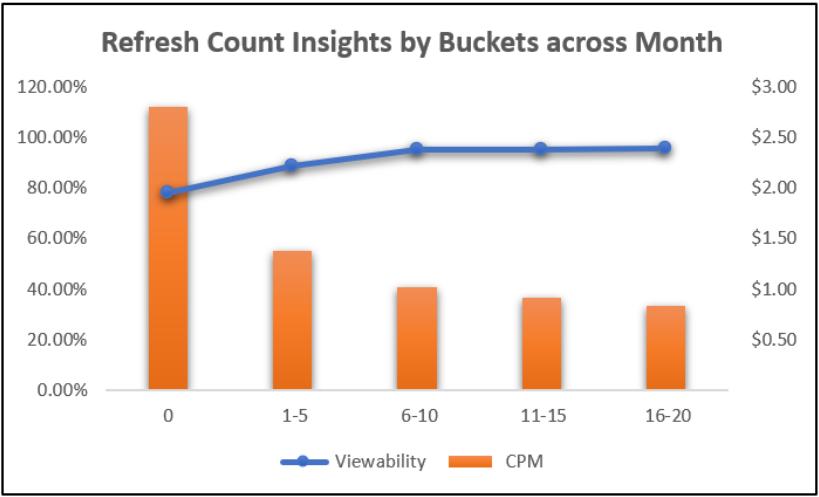

This month’s analysis focuses on how increasing ad refresh counts impact key performance indicators such as viewability, CPMs, and click-through rates. To simplify interpretation, refreshes are grouped into five buckets, each covering a range of five refreshes, with the first bucket representing the original (non-refreshed) impression. This structure enables us to observe how performance shifts with each additional refresh.

Report Overview:

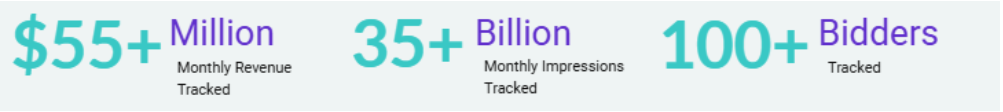

The DataBeat Programmatic Trends Report for May 2025 analyzes anonymized data from industry partners within the DataBeat network, focusing on programmatic advertising trends in the U.S. This report provides a detailed comparison of May 2025’s performance against both April 2025 and May 2024, offering insights into month-over-month and year-over-year changes.

Key Highlights:

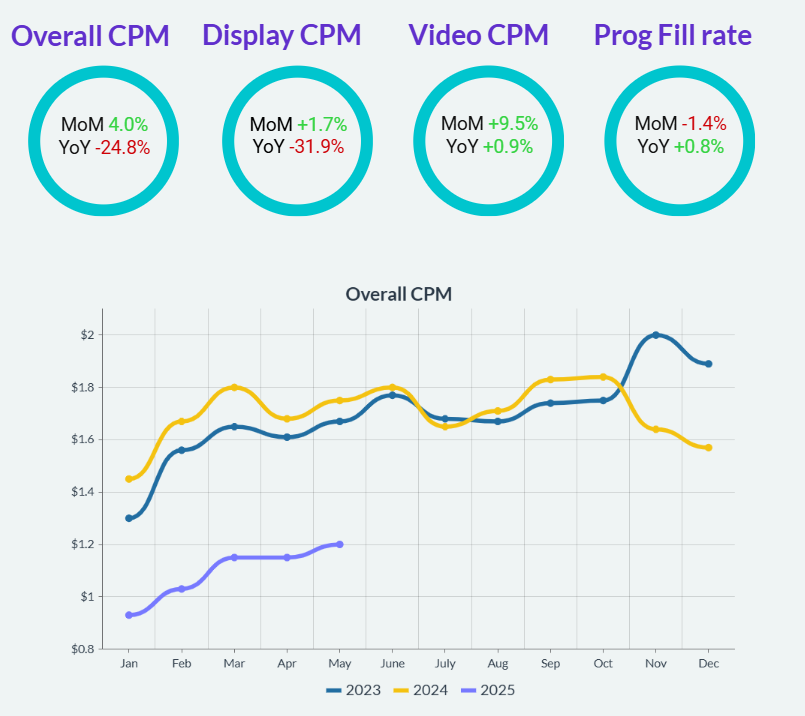

- MoM, Display CPMs increased by 1.7%, Video CPMs increased by 9.5%, resulting in 4% increase of overall CPM.

- YoY, Display CPMs declined by 31.9% and Video CPMs increased by 0.9%, leading to an overall CPM decrease of 24.8%.

The YoY decline in CPM from May 2024 to May 2025 may be influenced by the broader US political cycle. CPMs in May 2024 were notably elevated, likely due to early PMP campaign activations tied to the primary season as political parties began nominee selections. Following the 2024 election cycle, political ad spend has likely normalized. In addition, economic uncertainty linked to Trump’s renewed political activity may be dampening consumer confidence and tightening marketing budgets. This effect appears more pronounced among Chinese companies and marketplace sellers, who were previously strong contributors to ad revenue growth across social and retail media platforms. Their financial headwinds may be contributing to the softer CPM environment observed in 2025.

To mitigate the impact and drive recovery, publishers should focus on diversifying demand sources, optimizing floor prices, and leveraging header bidding to increase competition. Additionally, exploring high-performing ad formats and strengthening direct deals can help stabilize revenue in the coming months.