Benchmarking Methodology:

The DataBeat’s Programmatic Trends Report for June 2024 is based on an analysis of anonymized data gathered from various industry partners within the DataBeat network. In this report, we examined the performance of programmatic advertising demand in the United States for June 2024, comparing it to both May 2024 and June 2023 performances.

Key Highlights:

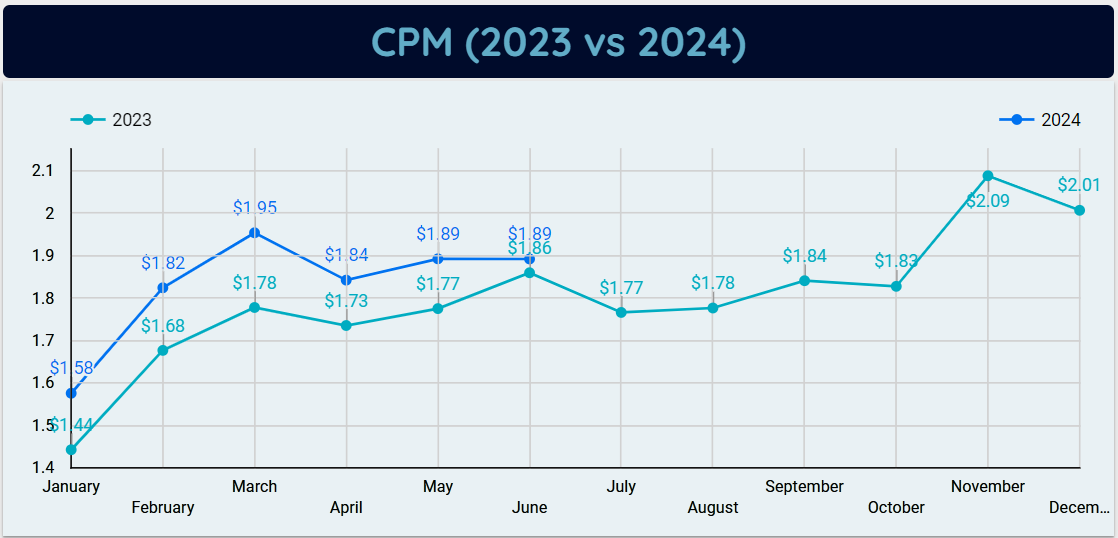

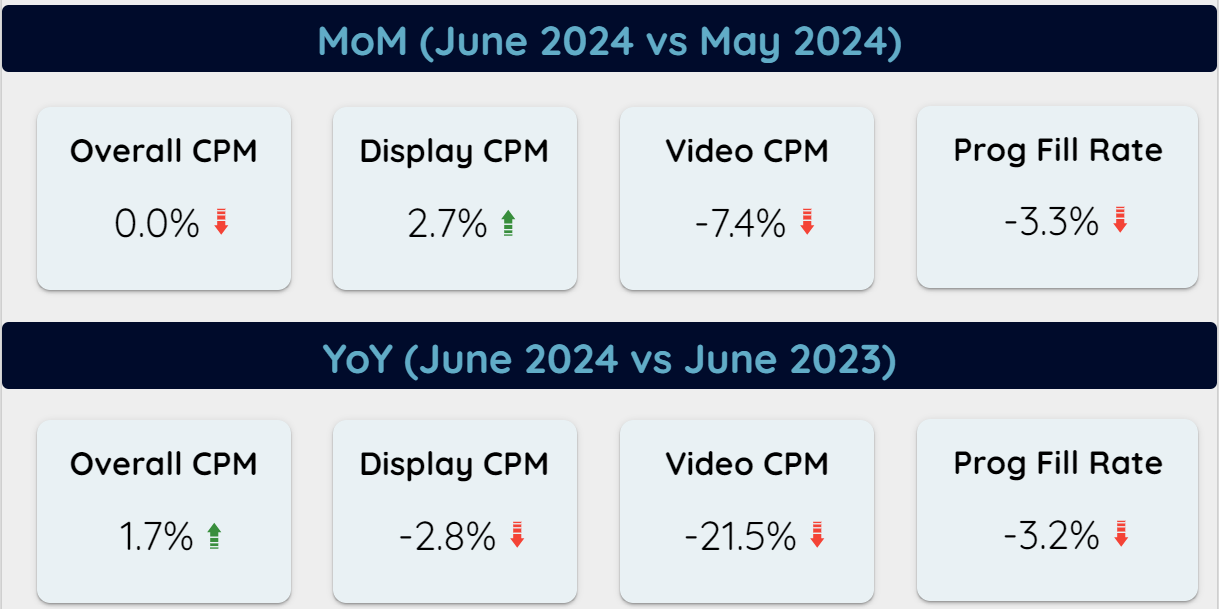

There has been no change in overall CPMs MoM, with a slight increase of 2% YoY, deviating from the 2023 trend. This shift is due to a significant drop in Video CPMs, down 7% MoM and 21% YoY. The industry continues to experience declining Video CPMs as it adjusts to the IAB’s guidelines, while advertisers are realigning their budgets accordingly.

Despite the 21% YoY decline in Video CPMs, overall CPMs still increased by nearly 2%. This increase is largely attributed to a significant volume shift from Display to Video, where Video volumes surged by 100%.

Media Trends:

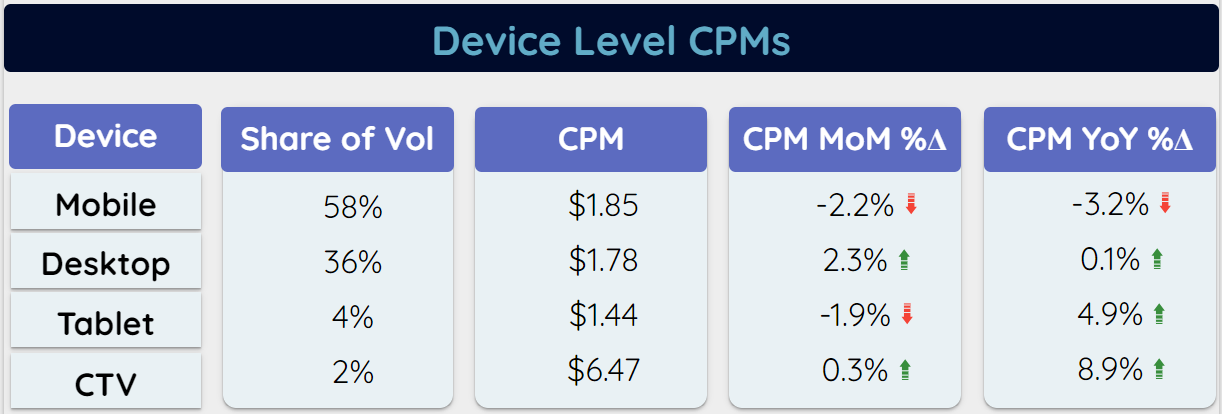

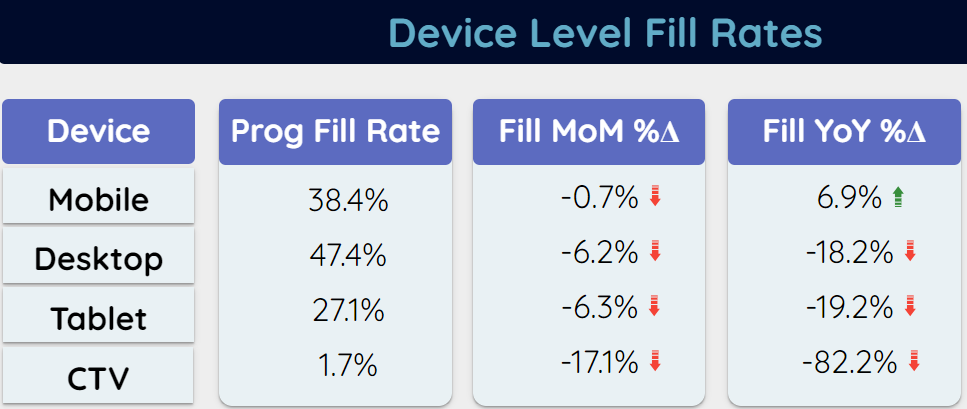

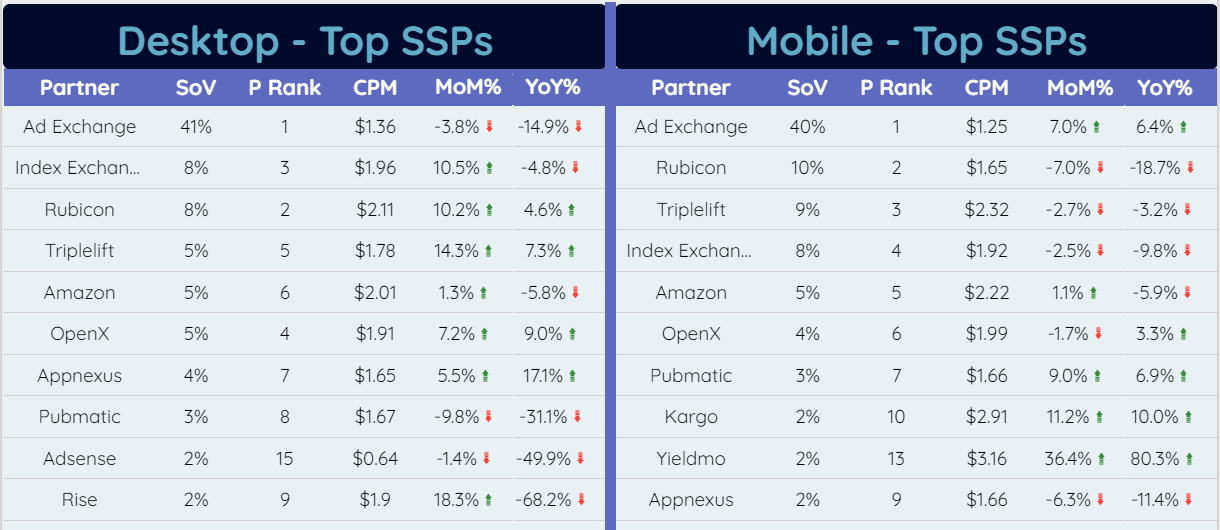

Device Trends:

- Mobile CPMs dropped by nearly 3% both MoM and YoY. In contrast, Desktop CPMs increased by 2% MoM. Interestingly, Mobile fill rates rose by 6% YoY, while Desktop fill rates declined by 6% MoM and 18% YoY.

- CTV programmatic fill rates plummeted by almost 82% YoY. This significant drop is due to a multi-fold increase in CTV requests from several publishers this year, which has adversely affected fill rates.

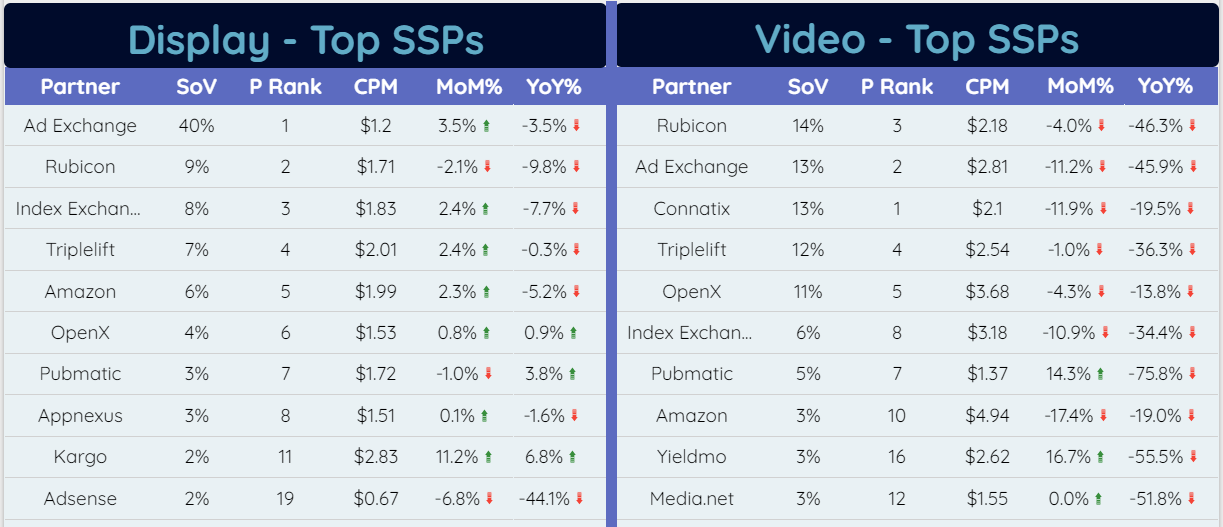

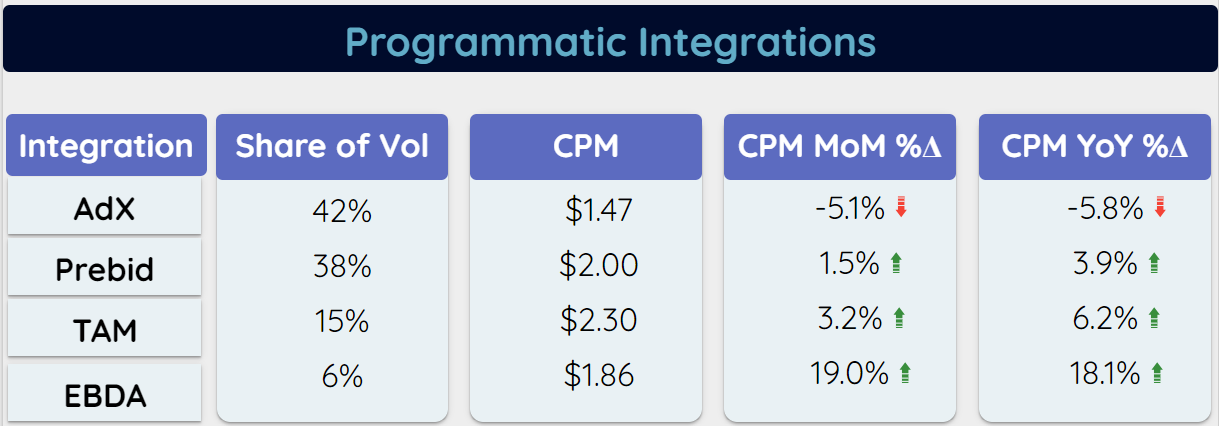

Programmatic Integrations Trends:

- AdX continues to dominate the programmatic space with a 42% share, yet its CPMs have dropped by nearly 5% both MoM and YoY, unlike other integrations. This decline is attributed to AdX’s higher video share at 60%, where video CPMs have seen a notable decrease as mentioned above

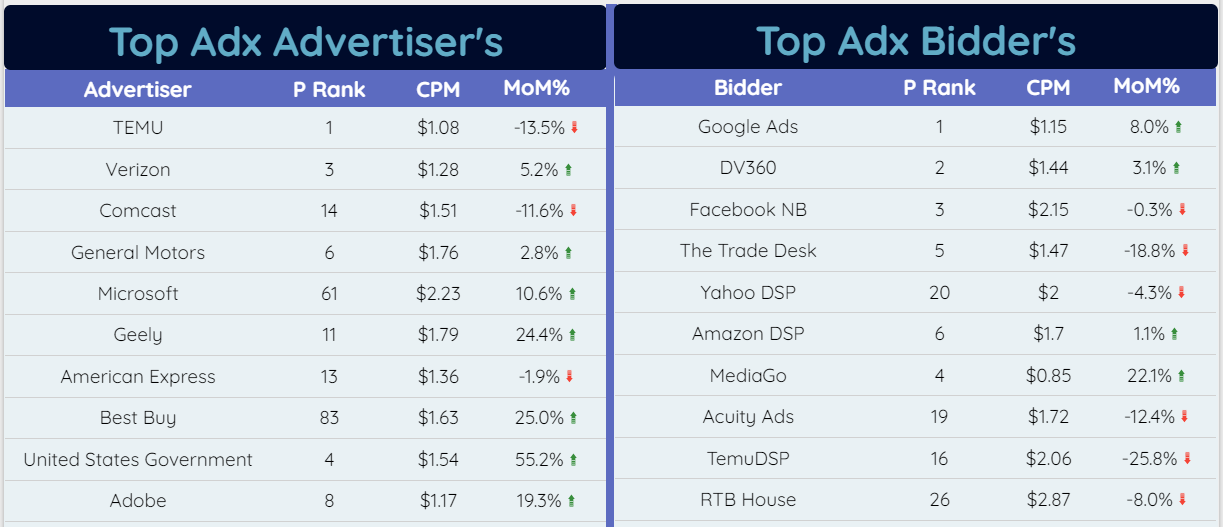

Top AdX Advertiser’s & Bidder’s:

- Among Advertisers, Microsoft rose through 55 ranks and stood at the 5th position with a significantly higher CPM of $2.2 compared to others along with Best Buy which jumped 72 ranks and stood at 8th rank.

- Interestingly, both Microsoft and Best Buy share prices increased by more than 15% in June due to more-than-expected profits.

- Amazon & Ford Motors are top decliners which used to be at 2nd & 6th rank respectively fell down to 16th & 20th ranks respectively.

- Among Bidders, Yahoo DSP rose through 15 ranks and stood at 5th rank. Interestingly, Yahoo partnered with VideoAmp in June and became the first DSP to integrate VideoAmp’s measurement and identity resolution to enhance targeting and measurement across TV and digital, with Yahoo ConnectID as the identity bridge.