Industry-Wise Demand Side Platform Performance: 2023 vs. 2024

- DV 360: The steady growth in volume and CPM for display and video ads underscores their value, while the consistent spending share across ad types indicates that advertisers are adhering to allocation strategies that continue to meet performance expectations.

- Yahoo & Amazon: Both platforms saw a decline in volume share (Amazon: -24%, Yahoo: -17%). However, Amazon DSP experienced a sharp CPM decline (-35%), in contrast to Yahoo’s CPM growth (+32%), which was driven by an increase in Yahoo’s video share from 15% to 22% compared to display.(The observed decline in Amazon DSP’s market share and eCPM could be attributed, in part, to a potential decrease in the number of advertising campaigns run on the platform in the past year compared to the previous year)

TTD: The Trade Desk’s 23% decline in volume share is closely tied to reduced spending in video categories, despite a rise in its CPM.

Report Overview:

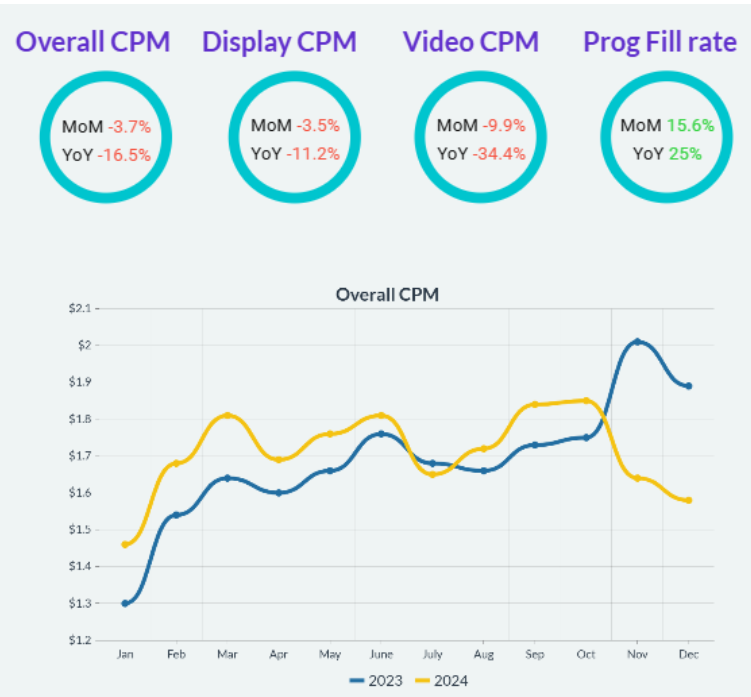

The DataBeat Programmatic Trends Report for December 2024 analyzes anonymized data from industry partners within the DataBeat network, focusing on programmatic advertising trends in the U.S. This report provides a detailed comparison of December 2024’s performance against both November 2024 and December 2023, offering insights into month-over-month and year-over-year changes.

Key Highlights:

MoM, Display CPMs declined by 3.5%, Video CPMs decreased by 9.9%, resulting in an overall CPM drop of 3.7%.

YoY, Display CPMs declined by 11.2% and Video CPMs dropped by 34.4%, leading to an overall CPM decrease of 16.5%.

As we kick off Q1, CPM trends typically see a slight dip following the holiday season, with a gradual rebound as advertisers ramp up their budgets. To optimize revenue, publishers should focus on diversifying demand sources, fine-tuning floor prices, and leveraging header bidding to increase competition.

1. Display Trend

- Display CPMs dropped by 3.5% month-over-month and experienced an 11% decline year-over-year.

- Almost all SSPs saw a month-over-month CPM drop, with the exception of AdX and Appnexus, indicating that this trend is consistent across most SSPs. However, when looking at year-over-year performance, some SSPs like OpenX, Appnexus, and Criteo demonstrated a significant increase in CPMs.

2. Video Trend

- Video CPMs dropped by 10% month-over-month and experienced a 34% decline year-over-year.

- Almost all SSPs saw a month-over-month CPM drop, with the exception of Telaria and Inmobi, indicating that this trend is consistent across most SSPs. However, when looking at year-over-year performance, some SSPs like Telaria, and Index Exchange demonstrated a significant increase in CPMs.

3. Device Trends

- Both Mobile and Desktop CPMs saw a month-over-month decrease, with Mobile dropping by 7% and Desktop by 1%. Year-over-year declines were also observed, with Mobile falling by 24% and Desktop by 10%.

- CTV CPMs decreased both month-over-month and year-over-year by 4.7% and 2.1%, respectively. Ad Exchange claimed the top rank in terms of volume.

4. Programmatic Integrations

- Prebid leads the market with a 41% share, closely followed by AdX at 38%, TAM at 13%, and EBDA at 8%. While CPMs for all integrations remained the same or declined month-over-month, Prebid saw a 3.3% increase.

- Prebid CPMs saw a significant 1.5% increase YoY, unlike AdX and TAM. This growth was primarily fueled by the strong performance of Appnexus, Criteo, Kargo, and Teads, which contributed to the uptick in CPMs.

5. AdX Advertisers

- Among advertisers, TEMU surged 372 ranks to secure the 1st position, achieving a remarkable CPM of $1.52, marking a staggering 10X increase in CPM MoM.

- Comcast and Adobe also saw significant rank increases, each achieving strong CPMs above $1 and marking a 26X rise in CPM for Comcast and 7X for Adobe.

6. AdX Bidders

- Google Ads and DV360 showed a slight increase in ranking among bidders, while other bidder rankings remained relatively stable.

- Most AdX bidders experienced an increase in CPMs month-over-month, with the exception of Facebook NB and Amazon DSP which showed decrease in their CPMs.

For a detailed overview, please download the full report.