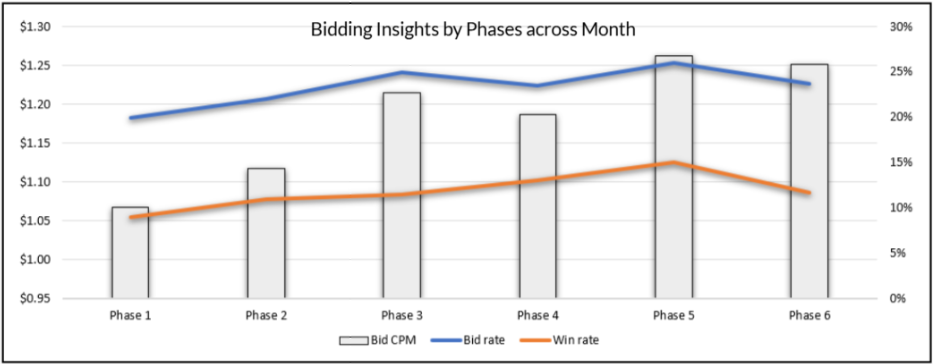

This month’s analysis highlights trends in bid CPMs, bid rates, and win rates across the month, segmented into phases of 5-day intervals each. This breakdown reveals shifting advertiser bidding behavior, demand pacing, and auction dynamics over time. The insights enable publishers to adjust floor prices more precisely and align yield strategies with real-time market conditions—driving improved revenue performance and inventory efficiency.

Bid Activity Trends Across 5-Day Buckets:

In the early part of the month (Phase 1), bid CPMs and bid rates are lower, as advertisers hold off on aggressive spending—often due to pacing strategies, budget approvals, or testing phases. This results in higher win rates for publishers due to lighter competition.

Phase 2 and 3 (mid-month) show a ramp-up in bidding activity, with increasing bid CPMs and more competitive auctions. Advertisers begin scaling campaigns based on earlier performance, leading to more pressure on win rates and rising demand for quality inventory.

In phase 4, there’s a brief dip in bid activity, likely tied to mid-month budget rebalancing. However, this is followed by a strong surge in phase 5 and 6 (end of month) as advertisers push to fully spend budgets, driving up bid CPMs and bid rates.

Suggestions for Publishers:

To better align monetization strategy with evolving campaign dynamics, publishers should consider adjusting floor prices across six defined monthly phases:

- Start of Month (Phase 1):

Set lower floors to attract early demand and maintain high fill during this typically low-density period.

- Early to Mid-Month (Phase 2, Days 6–10):

Increase floors by 10–15% as bid activity ramps up around days 7–8, capturing higher-value campaigns and boosting auction competitiveness.

- Mid-Month (Phase 3):

Maintain or slightly adjust floors as advertisers continue to optimize spend.

- Mid to Late Month (Phase 4):

Increase floors by an additional 10%. Note that advertisers may take 1–2 days to respond to floor price changes, so expect a slight delay in bidding adjustments.

- End of Month (Phases 5 & 6, Last 10 Days):

Enjoy peak CPM and fill rates as advertisers accelerate spending to fully utilize monthly budgets, driving the highest demand and yield.

Additionally, when publishers update floor prices through wrapper-based bid requests, they enable direct communication between inventory and demand sources, bypassing traditional mediation via AdX. In Prebid and TAM environments, this approach supports real-time floor price optimization, improving responsiveness to demand signals and enhancing overall yield.

Report Overview:

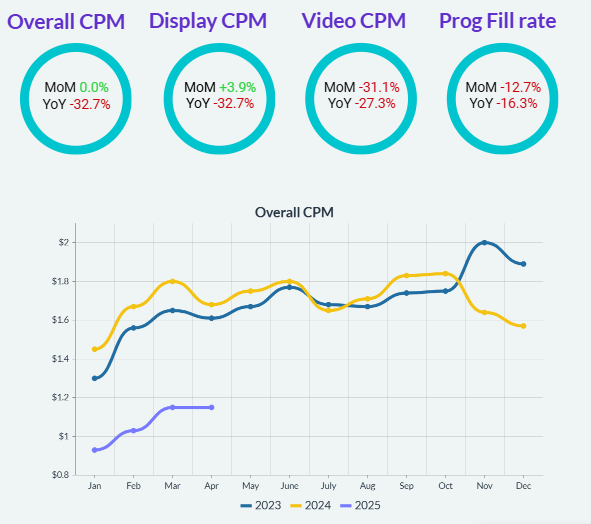

The DataBeat Programmatic Trends Report for April 2025 analyzes anonymized data from industry partners within the DataBeat network, focusing on programmatic advertising trends in the U.S. This report provides a detailed comparison of April 2025’s performance against both March 2025 and April 2024, offering insights into month-over-month and year-over-year changes.

Key Highlights:

- MoM, Display CPMs increased by 3.9%, Video CPMs decreased by 31.1%, resulting in no change of overall CPM.

- YoY, Display CPMs declined by 29.7% and Video CPMs declined by 13.3%, leading to an overall CPM decrease of 25%.

The YoY decline in CPM from April 2024 to April 2025 may be influenced by the broader US political cycle. CPMs in April 2024 were notably elevated, likely due to early PMP campaign activations tied to the primary season as political parties began nominee selections. In contrast, April 2025 has seen a marked CPM decline, potentially due to a reduction in political ad spend following the 2024 election cycle. Beyond politics, economic uncertainty linked to Trump’s renewed political activity may be dampening consumer confidence and tightening marketing budgets. This effect appears more pronounced among Chinese companies and marketplace sellers, who were previously strong contributors to ad revenue growth across social and retail media platforms. Their financial headwinds may be intensifying the downward pressure on CPMs observed in April 2025.

To mitigate the impact and drive recovery, publishers should focus on diversifying demand sources, optimizing floor prices, and leveraging header bidding to increase competition. Additionally, exploring high-performing ad formats and strengthening direct deals can help stabilize revenue in the coming months.

Here’s a look at industry trends, broken down by inventory and demand.

1. Display Trend

- Display CPMs increased by 3.9% month-over-month and experienced a 29.7% decline year-over-year.

- Most of the SSPs saw a month-over-month CPM decrease, indicating that this trend is consistent across most SSPs. When looking at year-over-year performance, all SSPs demonstrated a decrease in CPMs with an exception to Criteo.

2. Video Trend

- Video CPMs decreased by 31% month-over-month and experienced a 13% decrease year-over-year.

- Almost all SSPs saw a month-over-month CPM decrease with the exception of Triplelift, indicating that this trend is consistent across most SSPs. When looking at year-over-year performance all SSPs saw year-on-year decline.

3. Device Trends

- Mobile CPMs saw a month-over-month decrease whereas Desktop CPMs saw a month-over-month increase, with Mobile down by 2% and Desktop up by 7%. Year-over-year declines were also observed, with Mobile falling by 29% and Desktop by 28%.

- CTV CPMs decreased for month-over-month as well as year-over-year by 12% for both. Ad Exchange claimed the top rank in terms of volume.

4. Programmatic Integrations

- Prebid leads the market with a 37% share, closely followed by AdX at 29%, TAM at 25%, and EBDA at 9%. While CPMs for integrations such as AdX and Prebid increased month-over-month, year-over all integrations saw a decline in CPMs.

5. AdX Advertisers

- Among advertisers, Adobe surged ranks to claim one of the top positions, with a CPM of $0.77 with a 51% MoM decline.

- Wal-Mart and AT&T also saw notable rank increases, both maintaining CPMs above $0.80, with Wal-Mart experiencing a 19% CPM decrease and AT&T seeing a 50% decline.

6. AdX Bidders

- Google Ads and DV360 remain at the top in ranking among bidders, other bidder rankings remained relatively stable.

- Most AdX bidders experienced an increase in CPMs month-over-month, with the exception of TemuDSP , DV360 and Google Ads which showed decrease in their CPMs.

For a detailed overview, please download the full report.