Methodology for Programmatic Trend Analysis:

The DataBeat’s Programmatic Advertising Trends Report for April 2024 is based on an analysis of anonymized data gathered from various industry partners within the DataBeat network. In this report, this report explores the latest programmatic advertising trends by examining the performance of programmatic advertising demand in the United States for April 2024, comparing it to both March 2024 and April 2023 performances. By providing the latest programmatic advertising news and insights, we aim to shed light on the future of programmatic advertising.

Key Highlights:

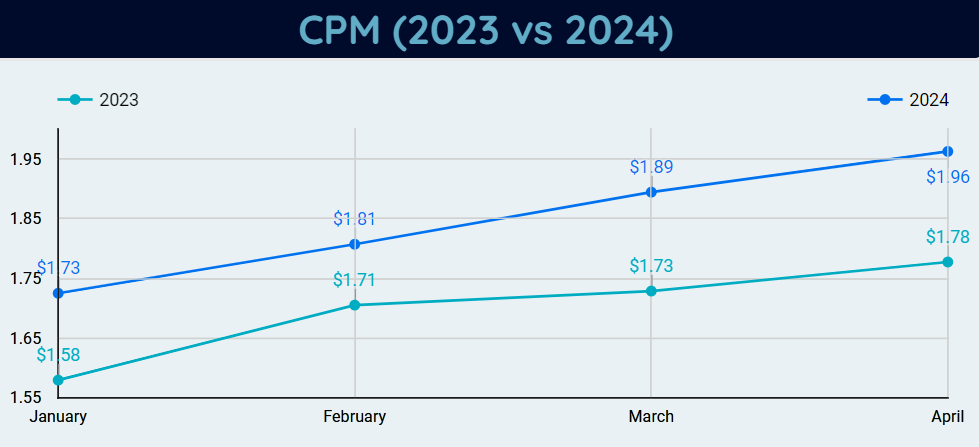

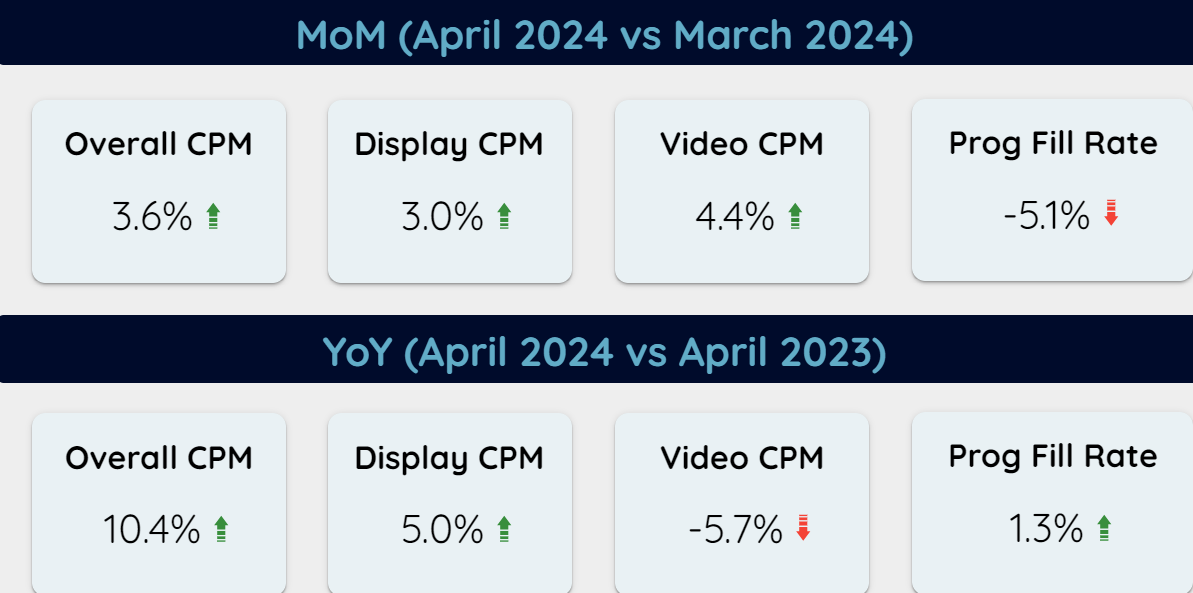

In 2024, CPM trends followed a similar pattern to 2023, steadily increasing over the months. Despite worries about Chrome cookie depreciation, which hasn’t fully happened yet, our KPIs remain strong both month-to-month and year-over-year. Google’s decision to delay cookie depreciation until 2025 adds to this stability.

This analysis of programmatic advertising trends provides valuable insights for understanding the future of programmatic advertising in light of the current industry

Device Trends:

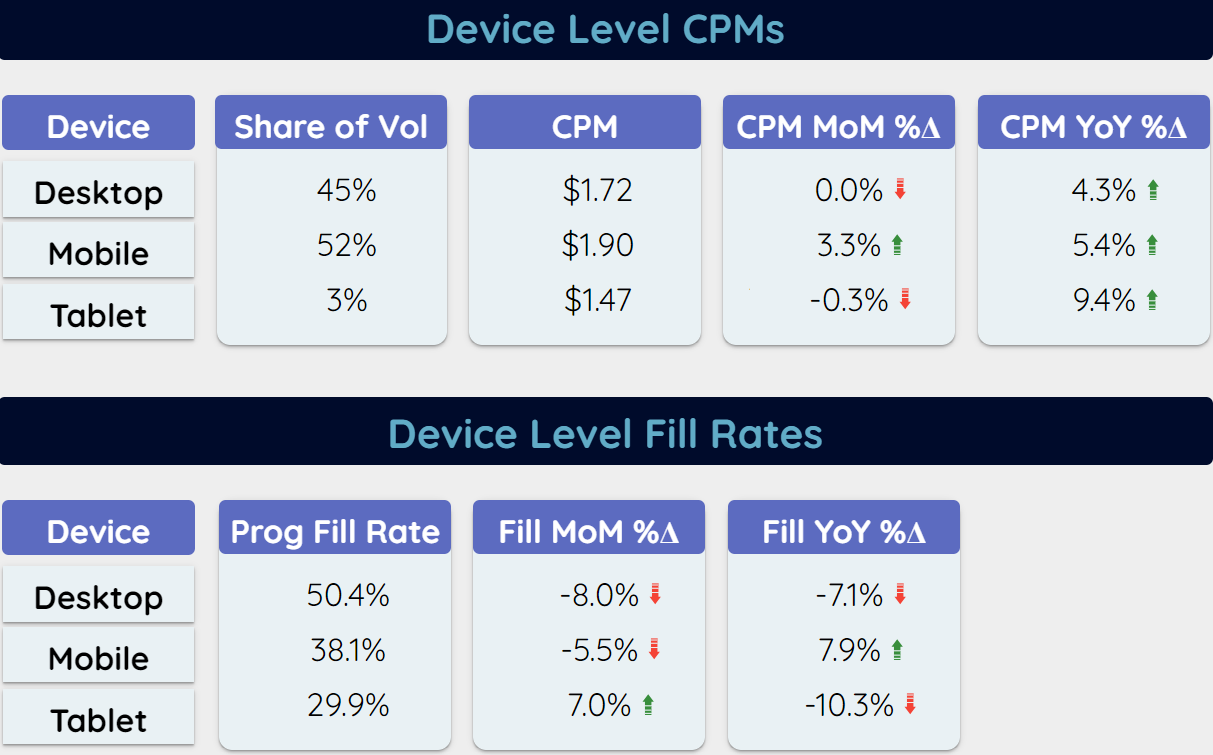

- The CPMs for desktop and tablet devices remained consistent compared to the previous month and there was a slight increase of 3% in CPMs for mobile devices compared to the previous month.

- Although average YoY CPMs increased by 10%, there is only a 5% increase across all devices. This increase is attributed to a shift in the share of volume from Display to Video YoY.

- Programmatic fill rates are comparatively better on Desktop when compared to Mobile however Desktop fill rates dropped both MoM & YoY by 8% & 7% respectively.This analysis highlights the dynamic shifts in programmatic advertising trends, emphasizing the importance of adapting strategies for future success.

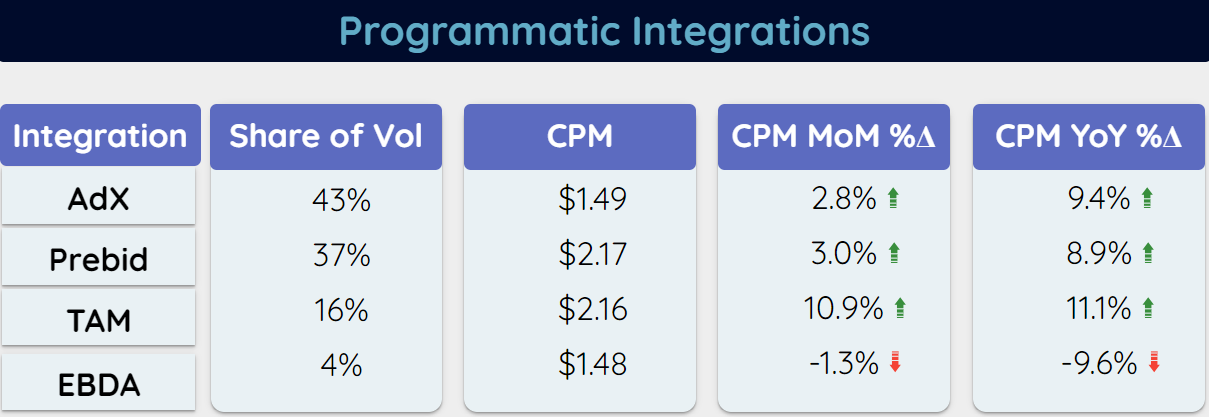

Programmatic Integrations Trends:

- CPMs exhibit robust performance across all integrations, showcasing positive trends both MoM and YoY. However, there’s a notable exception with the EBDA integration, where CPMs have dropped by 10% YoY. This decline hints at a potential gradual phasing out of EBDA.

This insight into programmatic advertising trends highlights the need for advertisers to continuously monitor integration performance to optimize their strategies for future success.

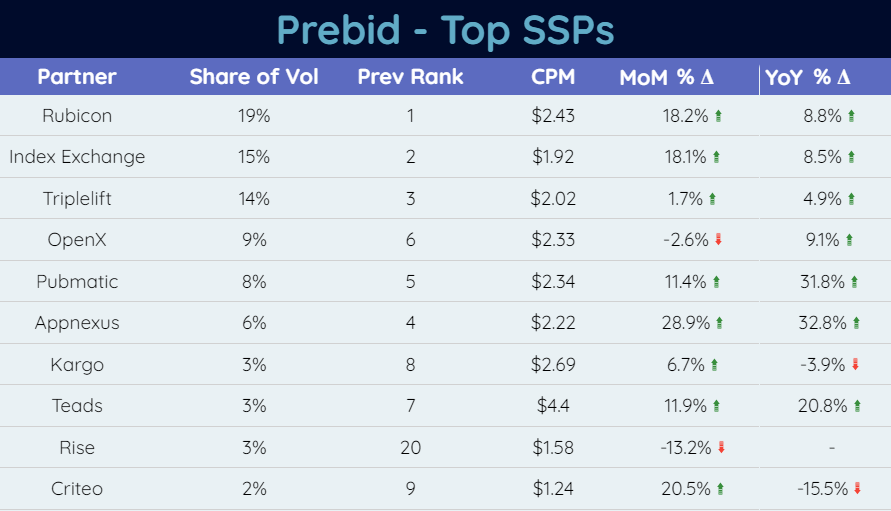

Prebid Top SSPs Highlights:

- In this analysis, we’ve introduced the previous month’s rank, determined by the share of volume, to monitor significant changes month-over-month.

- Notably, OpenX has ascended from 6th to the 4th rank, indicating an improvement in its performance.

- Similarly, Rise has experienced a significant rise in rank, climbing from 20th to 9th, despite a 13% drop in MoM CPM. This can be attributed to their new partnerships with Tier 1 publishers focussing on premium inventory which is indicated here in our Sellers Report

- Action Item: All the major publishers can focus on including or testing out Rise through Prebid as it is rising through the ranks interms of both volumes and performance

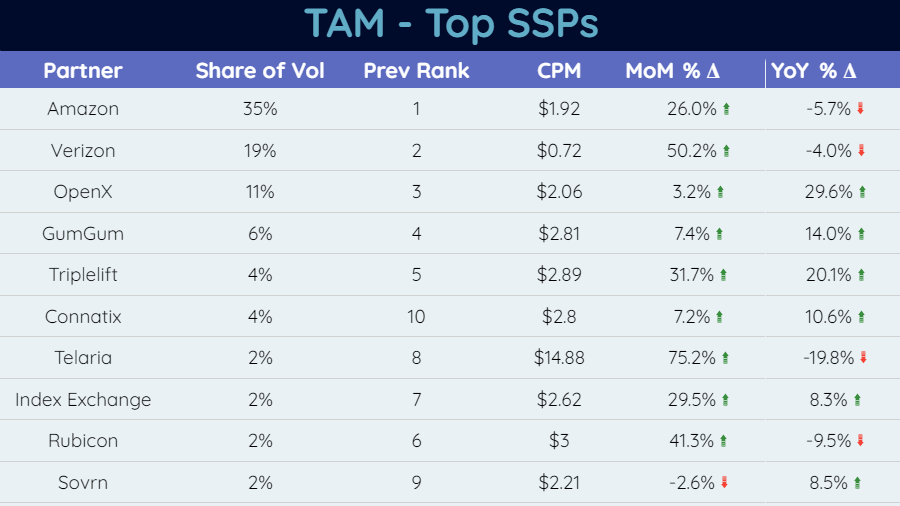

TAM Top SSPs Highlights:

- Here, All the top 5 SSPs ranks remind the same indicating their strong hold in the TAM integration however bottom 5 SSPs exchanged their ranks slightly

- Connatix is the notable SSP that has risen from rank rank 10 to rank 6 with consistent CPMs, showcasing its increasing prominence in programmatic advertising trends.

This shift highlights the dynamic nature of the programmatic advertising landscape and the importance of monitoring these changes to stay informed about the latest programmatic advertising news and anticipate the future of programmatic advertising.

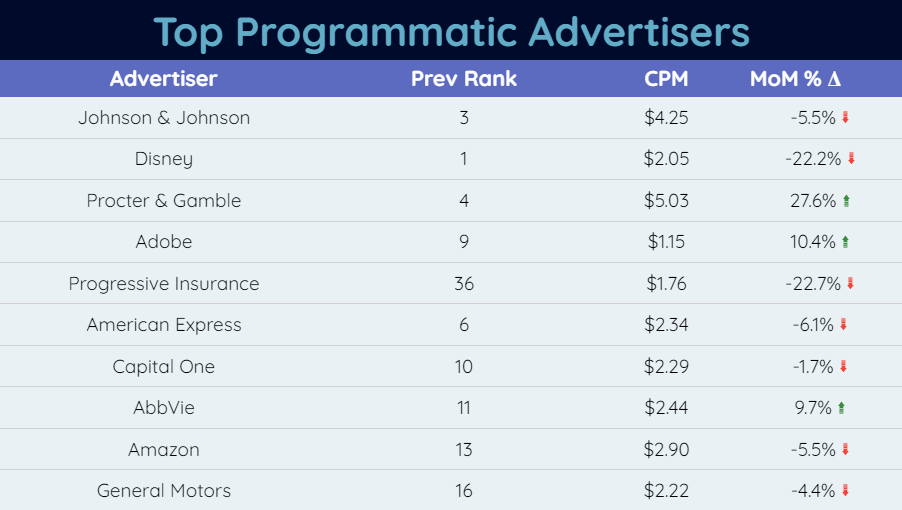

Top Programmatic Advertisers Highlights:

- Progressive Insurance has demonstrated remarkable progress, surging from rank 36 to rank 5, accompanied by a substantial 145% increase in volume.

- On the contrary, Allstate has experienced a stark decline, plummeting from rank 2 to rank 20, with its volume share witnessing a dramatic 70% decrease.

- Interestingly, Both Progressive and Allstate are American Insurance companies however both are exhibitng opposite trends in terms of their spending which indicates us to monitor the Insurance category closely in the coming months.

This divergence in spending trends highlights the importance of closely monitoring the insurance category for future programmatic advertising trends and insights.

Top Programmatic DSPs Highlights:

- Overall Rankings of all the top DSPS remained consistent comparing April to March

- Bidswitch has experienced a decline in rankings, dropping from 9th to 14th place, accompanied by a notable 27% decrease in volume share.