Benchmarking Methodology:

The DataBeat’s Programmatic Trends Report for May 2024 is based on an analysis of anonymized data gathered from various industry partners within the DataBeat network. In this report, we examined the performance of programmatic advertising demand in the United States for May 2024, comparing it to both April 2024 and May 2023 performances.

Key Highlights:

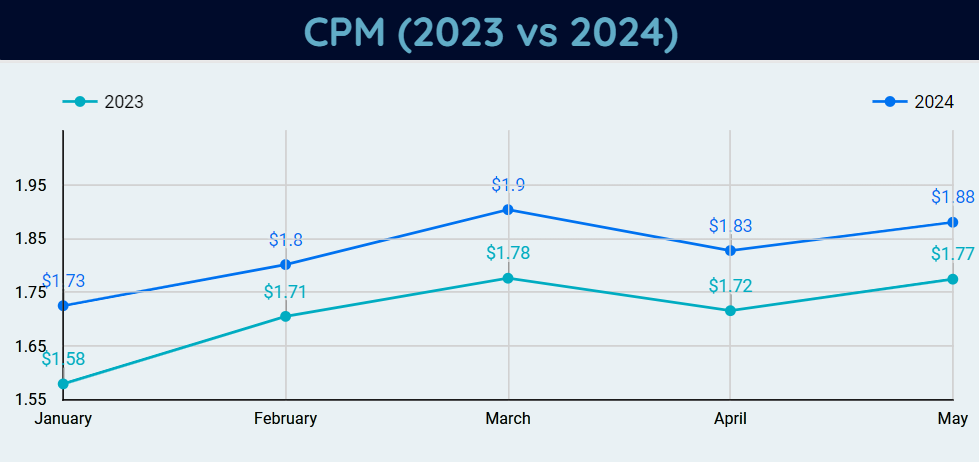

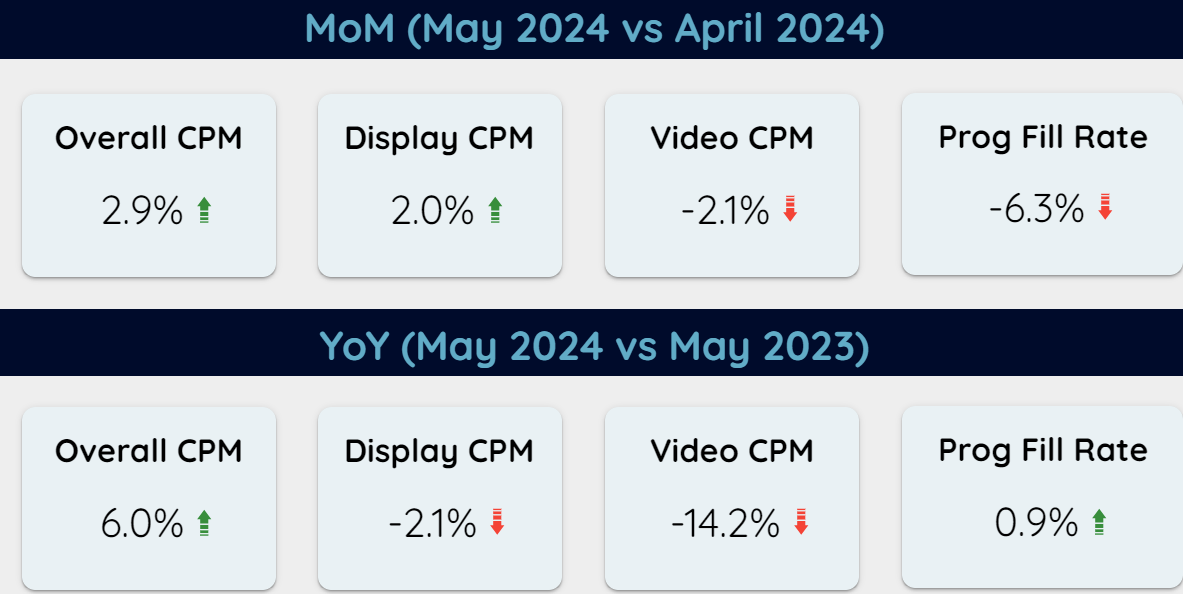

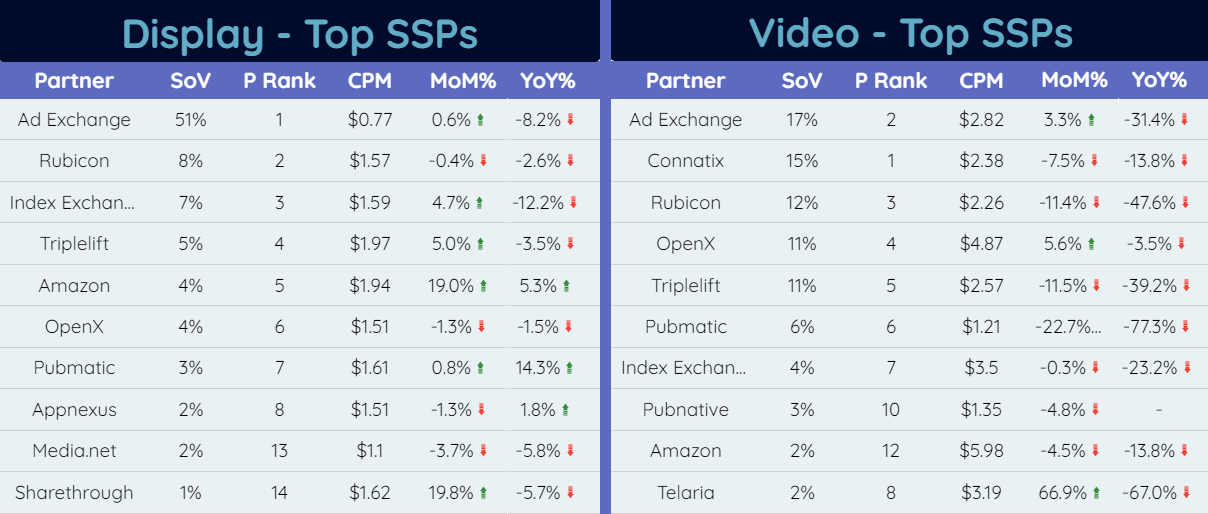

The CPM trends this year mirror those of last year, with May showing a recovery after the typical April decline caused by the quarter change. Although overall CPMs have improved compared to last year, Video CPMs remain weak. This weakness is primarily due to the industry’s adjustment to the IAB’s new video guidelines. Publishers and advertisers are gradually adapting to these changes. In the long term, however, these new guidelines will benefit everyone by enabling more accurate classification of premium inventory.

Overall CPMs saw a healthy increase, rising by 3% MoM and 6% YoY. This growth comes despite a drop in both Display and Video CPMs, driven by a significant shift in volumes from Display to Video. Notably, Video volumes surged by 11% MoM and an impressive 90% YoY.

Media Trends:

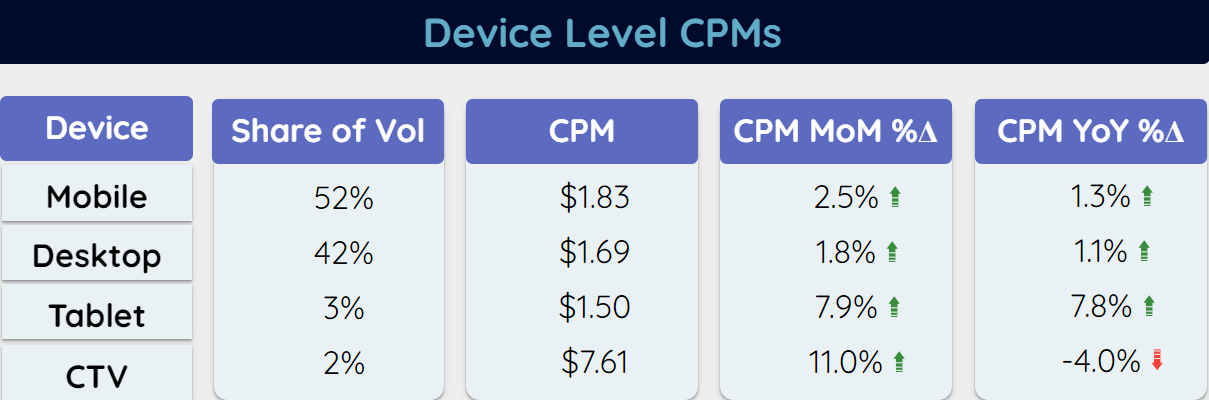

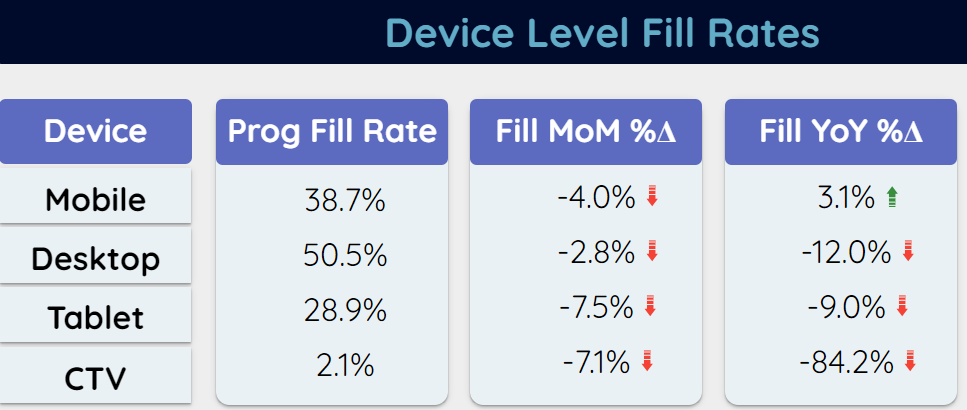

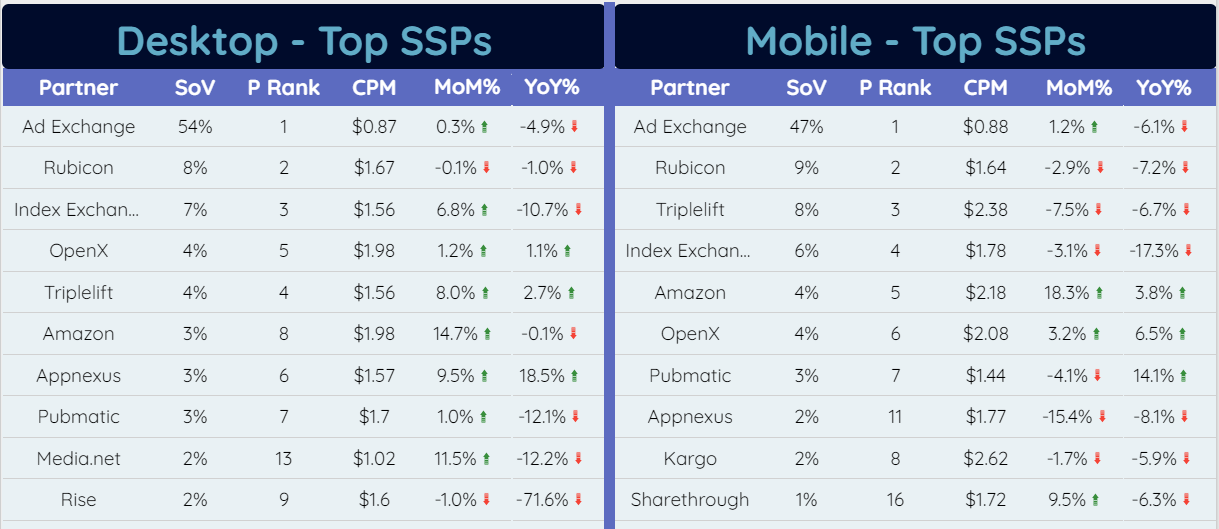

Device Trends:

- The CPMs for desktop and Mobile devices remained consistent when compared to both MoM & YoY with a slight increase.

- Overall MoM programmatic fill rates dropped by 6% on average across all the devices and we notice a slightly higher drop compared to YoY except for Mobile.

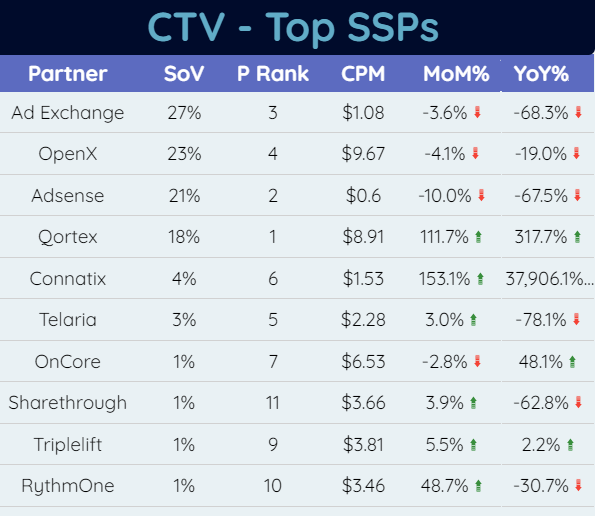

- CTV programmatic fill rates almost dropped by 85% YoY because CTV requests increased multi-fold for a few of the publishers this year affecting the fill rates.

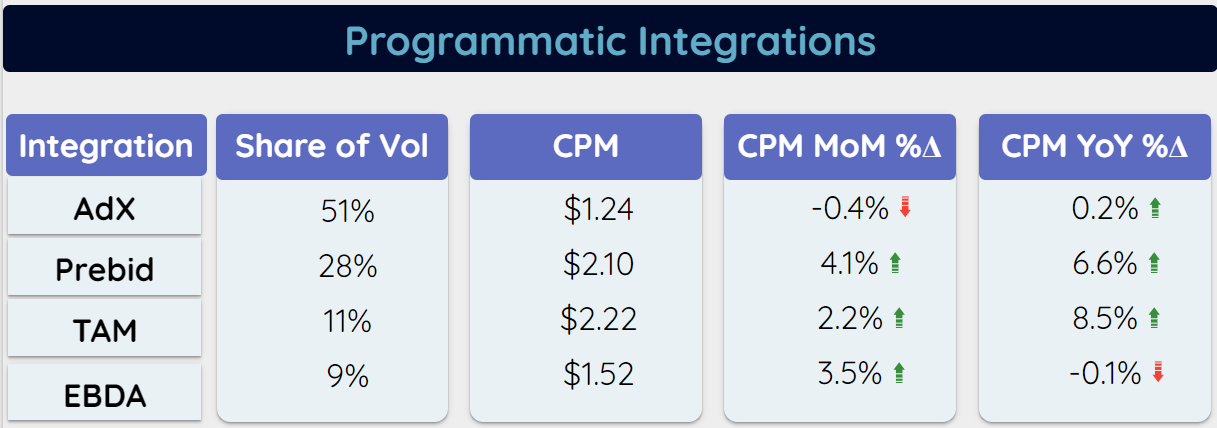

Programmatic Integrations Trends:

- AdX is still dominating the programmatic space with a 51% share however its CPMs remain constant MoM & YoY whereas Prebid & TAM CPMs increased by 5% on average both MoM & YoY

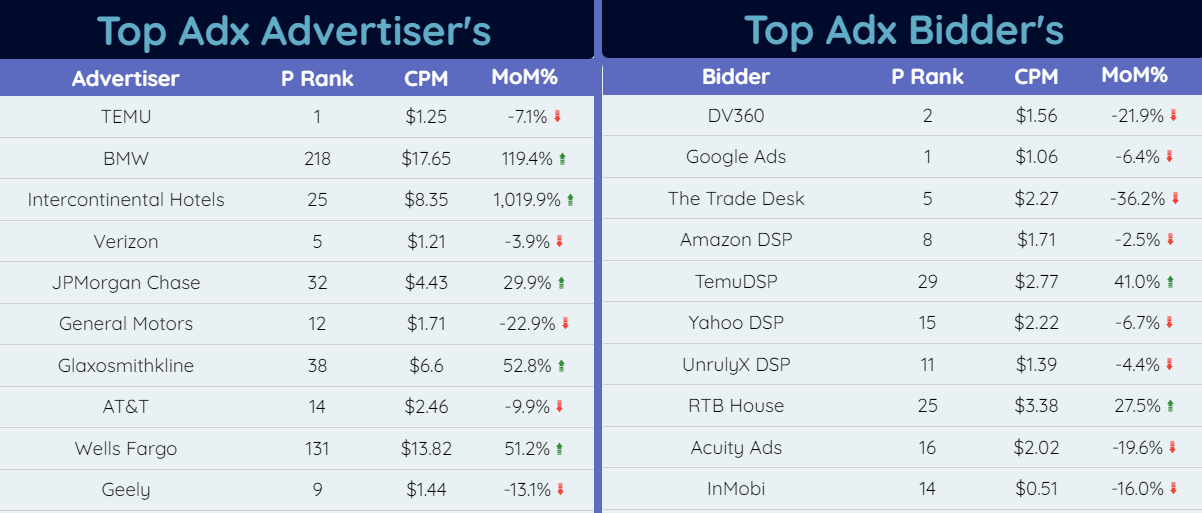

Top AdX Advertiser’s & Bidder’s:

- BMW rose through 217 ranks and stood at 2nd rank in May with a CPM of $18. Similarly, Wellfargo rose through 123 ranks and stood at 9th rank with a CPM of $14

- TEMU-DSP rose through 25 ranks and stood at 5th rank among bidders which is a noticeable change along with RTB House at 8th rank